Graduate and internship applications

Our firms offer opportunities for you to build an enjoyable career pathway, whether you're looking for a role in business advisory, audit, tax or insolvency, or to see what it's like to work for an accounting and advisory firm.

Make your future count...

Baker Tilly Staples Rodway one of NZ's top grad employers, says Prosple

We've been named Number 22 on an annual list of New Zealand’s top 100 grad employers and we have one of the top grad satisfaction ratings in accounting and advisory. The ranking comes from Prosple – an international job platform for university students. "We’re very focused on training and mentoring our graduates," says Baker Tilly Staples Rodway national chair David Searle. "We know our people thrive when they feel happy and supported. We achieve that in multiple ways, including provision of fulfilling career opportunities, flexibility, variety and by simply treating each other well.” Read more here or click here to see our page on Prosple.

We've been named Number 22 on an annual list of New Zealand’s top 100 grad employers and we have one of the top grad satisfaction ratings in accounting and advisory. The ranking comes from Prosple – an international job platform for university students. "We’re very focused on training and mentoring our graduates," says Baker Tilly Staples Rodway national chair David Searle. "We know our people thrive when they feel happy and supported. We achieve that in multiple ways, including provision of fulfilling career opportunities, flexibility, variety and by simply treating each other well.” Read more here or click here to see our page on Prosple.

... and we're a finalist in industry awards for graduate employers

In late 2024, we were a finalist in the annual New Zealand Association of Graduate Employers (NZAGE) Industry Awards. These recognise excellence in the early talent space and our nomination was due to work we did with Talent Solutions to consider how best to articulate the many benefits of becoming a grad with Baker Tilly Staples Rodway. Want to know what they are? Here’s what our grads say…

In late 2024, we were a finalist in the annual New Zealand Association of Graduate Employers (NZAGE) Industry Awards. These recognise excellence in the early talent space and our nomination was due to work we did with Talent Solutions to consider how best to articulate the many benefits of becoming a grad with Baker Tilly Staples Rodway. Want to know what they are? Here’s what our grads say…

Sign up to get our grad & intern newsletters!

Make your future count

Have you dreamed of a workplace that offers national and international support, expertise and reach, as well as the friendly, personal care of a smaller employer? Sign up to become one of our grads or interns today!

We are one of New Zealand's leading accounting networks, with nationwide member firms. If you start your story with us, you'll be working for one of the most established and reputable networks in the accounting and advisory market, so you know you're making a solid choice for your career.

Not only are we locally owned and operated, we're an independent member of the Baker Tilly International network, which spans 145 territories. We offer potential opportunities for secondment, and relationships that help open doors around the world.

And, while we're large, we're friendly. You'll work closely with our directors and be involved with clients from day one. There will also be opportunities to unwind because while we take utmost pride in our work, we value work-life balance and good relationships. So what are you waiting for? See our vacancies or register for future roles. We look forward to hearing from you!

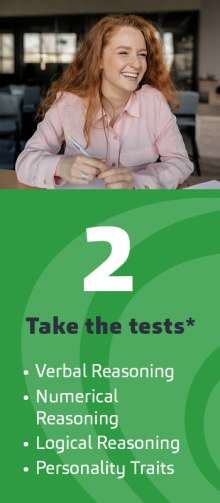

* To apply for a role, you may need to undertake psychometric testing. It's an online assessment that will take approximately an hour and helps us understand more about you.

*To apply for a role in Hawke's Bay you will need to undertake additional testing on ability and accounting skills.

We provide great range of benefits to our graduate including:

- CAANZ or CPA fees paid

- Mentor programme

- Buddy programme

- National graduate induction

- In-house training and national training

- Volunteer day leave

- Paid study leave and exam support

- Flexible working

- Graduation leave

- Dress for your day

- Exposure to a variety of work

- Direct client contact

- International secondment opportunities

- Partner funded social club

* Not all are applicable to all roles and offices

We are one of New Zealand's leading accounting networks, with nationwide member firms. If you start your story with us, you'll be working for one of the most established and reputable networks in the accounting and advisory market, so you know you're making a solid choice for your career.

Not only are we locally owned and operated, we're an independent member of the Baker Tilly International network, which spans 145 territories. We offer potential opportunities for secondment, and relationships that help open doors around the world.

And, while we're large, we're friendly. You'll work closely with our directors and be involved with clients from day one. There will also be opportunities to unwind because while we take utmost pride in our work, we value work-life balance and good relationships. So what are you waiting for? See our vacancies or register for future roles. We look forward to hearing from you!

* To apply for a role, you may need to undertake psychometric testing. It's an online assessment that will take approximately an hour and helps us understand more about you.

*To apply for a role in Hawke's Bay you will need to undertake additional testing on ability and accounting skills.

We provide great range of benefits to our graduate including:

- CAANZ or CPA fees paid

- Mentor programme

- Buddy programme

- National graduate induction

- In-house training and national training

- Volunteer day leave

- Paid study leave and exam support

- Flexible working

- Graduation leave

- Dress for your day

- Exposure to a variety of work

- Direct client contact

- International secondment opportunities

- Partner funded social club

* Not all are applicable to all roles and offices

Grad service lines

To be effective, audit and assurance work demands a deep understanding of a client’s business, its goals and the market in which it operates. Our client base is diverse and we use a “paperless” audit approach. Our sophisticated evaluation and analytical tools help us identify our clients' risks and opportunities.

Audit and Assurance graduates learn to:

- Understand and identify audit risks, audit evidence, laws and regulations

- Prepare audit work papers and develop an understanding of financial statements and audit opinions

- Understand key accounting and auditing standards

- Use key audit software and systems

- Understand clients’ businesses and industries

If you enjoy staying informed and thinking creatively, the ever-changing world of tax may appeal to you. Most business owners appreciate the importance of controlling costs and welcome ways to legitimately minimise their tax. We are experienced tax specialists who are happy to help new team members develop their tax skills.

Tax graduates learn to:

- Prepare GST, FBT, NRWT, RWT and income tax returns and reconciliations

- Compile complete income tax returns, cross-referenced to financial statements

- Understand the tax journals of each tax entity

- Comprehend assessable income and deductible expenditure

- Understand provisional tax regime, tax pooling and UOMI

- Understand clients’ businesses and the industries they operate in

- Liaise with Inland Revenue

- Undertake research including reading legislation and tax commentary

- Use tax software

Our Business Advisory Services team works with a broad range of New Zealand and overseas businesses including some of this country’s most successful companies. As a graduate, you will have the opportunity to work closely with (and be mentored by) advisors who have achieved outstanding accomplishments throughout their careers.

Business Advisory graduates learn to:

- Understand clients’ businesses and industries

- Understand the accounts function of a business

- Comprehend professional standards, compliance and regulatory requirements, including professional ethics

- Draft financial reports, including financial statements and tax returns

- Comprehend assessable income and deductible expenditure

- Prepare electronic work papers, GST, FBT, RWT and PAYE returns and reconciliations

- Use key software i.e. Xero, APS and Microsoft Suite, in particular, Excel

All businesses face challenges at some stage in their life cycle. Our Business Recovery and Restructuring team works with directors, shareholders, banks, lenders and creditors to help distressed businesses move into the black. When this is not possible, the team assists with the closure of the business in a way that obtains the best possible result for stakeholders. You will have the opportunity to work with well-regarded industry experts and top-tier clients.

Business Recovery and Restructuring graduates learn to:

- Understand and analyse a wide range of different businesses and industries.

- Meet and correspond with clients and stakeholders, and provide options and recommendations.

- Manage asset realisation processes (including the sale of businesses)

- Analyse financial information, produce financial reports and undertake investigations

- Assist with negotiations and legal matters (including litigation)

- Draft reports for clients (including statutory reports)

- Understand and assist with the management of liquidations, receiverships and voluntary administrations.

- Use a variety of key software products.

We have offices across New Zealand

While members of our network broadly hold the same values, each office has its own culture, benefits and community sponsorships. Are you excited to find out what you’ll experience as a member of our team? Click the following links to discover our regional perks, testimonials and more! Auckland, Tauranga, Waikato, Taranaki, Hawke’s Bay, Wellington, Christchurch.

While members of our network broadly hold the same values, each office has its own culture, benefits and community sponsorships. Are you excited to find out what you’ll experience as a member of our team? Click the following links to discover our regional perks, testimonials and more! Auckland, Tauranga, Waikato, Taranaki, Hawke’s Bay, Wellington, Christchurch.

Testimonials

"This collaborative atmosphere has not only made my transition smooth but has also encouraged me to grow and develop my skills at an impressive pace. I’ve had the chance to gain valuable experience in a short amount of time, diving into real-world auditing tasks and learning from industry professionals."

"The support system went beyond what I’d expected and asked for, allowing me to grow professionally. Overall, my time at Baker Tilly Staples Rodway has been full of pleasant experiences."

"One of the many aspects I enjoy is Baker Tilly Staples Rodway’s flexible working arrangements, which allow me to have the right work-life balance."

"Being surrounded by such a driven group of people inspires you and encourages you to work hard and provide the best results."

"Training is vital for graduates and the training culture at Baker Tilly Staples Rodway is outstanding. They prioritise training, offering extensive sessions not only within your working area but also in other areas such as tax."

"Baker Tilly Staples Rodway appealed to me due to the company’s genuine interest in my professional development. My BAS managers/partners are always available for questions and willing to sit down and work through any issues I have."

"I chose Baker Tilly Staples Rodway for its mid-tier position. It’s large enough to provide exposure to a diverse range of clients, while also maintaining a collaborative and supportive team environment."

"This collaborative atmosphere has not only made my transition smooth but has also encouraged me to grow and develop my skills at an impressive pace. I’ve had the chance to gain valuable experience in a short amount of time, diving into real-world auditing tasks and learning from industry professionals."

"The support system went beyond what I’d expected and asked for, allowing me to grow professionally. Overall, my time at Baker Tilly Staples Rodway has been full of pleasant experiences."

"One of the many aspects I enjoy is Baker Tilly Staples Rodway’s flexible working arrangements, which allow me to have the right work-life balance."

"Being surrounded by such a driven group of people inspires you and encourages you to work hard and provide the best results."

"Training is vital for graduates and the training culture at Baker Tilly Staples Rodway is outstanding. They prioritise training, offering extensive sessions not only within your working area but also in other areas such as tax."

"Baker Tilly Staples Rodway appealed to me due to the company’s genuine interest in my professional development. My BAS managers/partners are always available for questions and willing to sit down and work through any issues I have."

"I chose Baker Tilly Staples Rodway for its mid-tier position. It’s large enough to provide exposure to a diverse range of clients, while also maintaining a collaborative and supportive team environment."

A Day in the Life

Find out what a typical working day might look like for our team members, grads and interns...

Grads and interns rising to the top

Your career path with us

After signing your contract, you’ll officially join our network and start connecting with your colleagues at team and social events. The February graduate cohort kicks off with an induction at your local office, followed by a three-day national induction in Auckland. This is a great chance to meet other grads and get familiar with our clients and services. You’ll get all the tools and training you need to hit the ground running.

If you’re working towards your CA ANZ or CPA qualification, you’ll be paired with a mentor to guide you through the practical experience requirements. Our offices are all certified as Registered Training Employers (RTE) or Approved Training Employers (ATE) by CA ANZ, so you can be confident that we will give you the skills you need to succeed in your accounting career.

You will be supported by your team, which depending on your office and service line could include a dedicated buddy, manager and mentor to help you as you settle in. Your manager will also provide regular feedback on your performance, including formal reviews and an annual salary review.

Learning and development are a key part of our Graduate Programme. We offer regular, structured training to help you grow on your journey to becoming a trusted advisor. You will also have the opportunity to specialise in areas of interest on your path to becoming a Chartered Accountant. By joining the Baker Tilly Staples Rodway network, you’ll tap into both national and international resources. We also hold annual training sessions that focus on both technical skills and soft skills to ensure you’re always learning and growing.