Graduate applications

Applications for our 2025 graduate programme are now open.

Our member firms offer many opportunities for you to build an enjoyable career pathway, whether you're looking for a role in business advisory, audit or tax, or simply to discover what it's like to work for an accounting and advisory firm.

Baker Tilly Staples Rodway voted one of NZ's top grad employers

In 2024, we were named Number 26 on a list of New Zealand’s top 100 grad employers and third in accounting and advisory. The ranking comes from Prosple – an international job platform for university students. "We’re very focused on training and mentoring our graduates," says Baker Tilly Staples Rodway national chair David Searle. "We know our people thrive when they feel happy and supported. We achieve that in multiple ways, including provision of fulfilling career opportunities, flexibility, variety, friendly office cultures and by simply treating each other well.” Read more here...

In 2024, we were named Number 26 on a list of New Zealand’s top 100 grad employers and third in accounting and advisory. The ranking comes from Prosple – an international job platform for university students. "We’re very focused on training and mentoring our graduates," says Baker Tilly Staples Rodway national chair David Searle. "We know our people thrive when they feel happy and supported. We achieve that in multiple ways, including provision of fulfilling career opportunities, flexibility, variety, friendly office cultures and by simply treating each other well.” Read more here...

Sign up to see our grad & intern positions and receive our newsletters!

Success starts here

Have you dreamed of a workplace that offers national and international support, expertise and reach, as well as the friendly, personal care of a smaller employer? Sign up to become one of our grads or interns today!

We are one of New Zealand's leading accounting networks, with nationwide member firms. If you start your story with us, you'll be working for one of the most established and reputable networks in the accounting and advisory market, so you know you're making a solid choice for your career.

Not only are we locally owned and operated, we're an independent member of the Baker Tilly International network, which spans 145 territories. We offer potential opportunities for secondment, and relationships that help open doors around the world.

And, while we're large, we're friendly. You'll work closely with our directors and be involved with clients from day one. There will also be opportunities to unwind because while we take utmost pride in our work, we value work-life balance and good relationships. So what are you waiting for? See our vacancies or register for future roles. We look forward to hearing from you!

* To apply for a role, you may need to undertake psychometric testing. It's an online assessment that will take approximately an hour and helps us understand more about you.

*To apply for a role in Hawke's Bay you will need to undertake additional testing on ability and accounting skills.

We provide great range of benefits to our graduate including:

- CAANZ or CPA fees paid

- Mentor programme

- Buddy programme

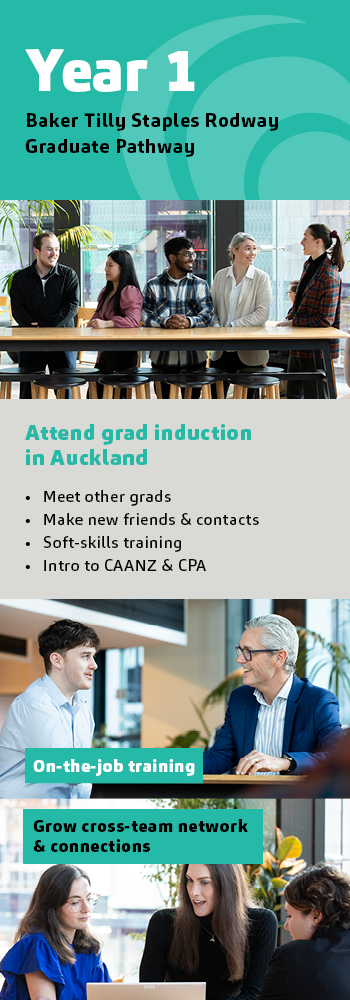

- National graduate induction

- In-house training and national training

- Volunteer day leave

- Paid study leave and exam support

- Flexible working

- Graduation leave

- Dress for your day

- Exposure to a variety of work

- Direct client contact

- International secondment opportunities

- Partner funded social club

* Not all are applicable to all roles and offices

We are one of New Zealand's leading accounting networks, with nationwide member firms. If you start your story with us, you'll be working for one of the most established and reputable networks in the accounting and advisory market, so you know you're making a solid choice for your career.

Not only are we locally owned and operated, we're an independent member of the Baker Tilly International network, which spans 145 territories. We offer potential opportunities for secondment, and relationships that help open doors around the world.

And, while we're large, we're friendly. You'll work closely with our directors and be involved with clients from day one. There will also be opportunities to unwind because while we take utmost pride in our work, we value work-life balance and good relationships. So what are you waiting for? See our vacancies or register for future roles. We look forward to hearing from you!

* To apply for a role, you may need to undertake psychometric testing. It's an online assessment that will take approximately an hour and helps us understand more about you.

*To apply for a role in Hawke's Bay you will need to undertake additional testing on ability and accounting skills.

We provide great range of benefits to our graduate including:

- CAANZ or CPA fees paid

- Mentor programme

- Buddy programme

- National graduate induction

- In-house training and national training

- Volunteer day leave

- Paid study leave and exam support

- Flexible working

- Graduation leave

- Dress for your day

- Exposure to a variety of work

- Direct client contact

- International secondment opportunities

- Partner funded social club

* Not all are applicable to all roles and offices

Our Service Lines

To be effective, audit and assurance work demands a deep understanding of a client’s business, its goals and the market in which it operates. Our client base is diverse and we use a “paperless” audit approach. Our sophisticated evaluation and analytical tools help us identify our clients' risks and opportunities.

Audit and Assurance graduates learn to:

- Understand and identify audit risks, audit evidence, laws and regulations

- Prepare audit work papers and develop an understanding of financial statements and audit opinions

- Understand key accounting and auditing standards

- Use key audit software and systems

- Understand clients’ businesses and industries

If you enjoy staying informed and thinking creatively, the ever-changing world of tax may appeal to you. Most business owners appreciate the importance of controlling costs and welcome ways to legitimately minimise their tax. We are experienced tax specialists who are happy to help new team members develop their tax skills.

Tax graduates learn to:

- Prepare GST, FBT, NRWT, RWT and income tax returns and reconciliations

- Compile complete income tax returns, cross-referenced to financial statements

- Understand the tax journals of each tax entity

- Comprehend assessable income and deductible expenditure

- Understand provisional tax regime, tax pooling and UOMI

- Understand clients’ businesses and the industries they operate in

- Liaise with Inland Revenue

- Undertake research including reading legislation and tax commentary

- Use tax software

Our Business Advisory Services team works with a broad range of New Zealand and overseas businesses including some of this country’s most successful companies. As a graduate, you will have the opportunity to work closely with (and be mentored by) advisors who have achieved outstanding accomplishments throughout their careers.

Business Advisory graduates learn to:

- Understand clients’ businesses and industries

- Understand the accounts function of a business

- Comprehend professional standards, compliance and regulatory requirements, including professional ethics

- Draft financial reports, including financial statements and tax returns

- Comprehend assessable income and deductible expenditure

- Prepare electronic work papers, GST, FBT, RWT and PAYE returns and reconciliations

- Use key software i.e. Xero, APS and Microsoft Suite, in particular, Excel

All businesses face challenges at some stage in their life cycle. Our Business Recovery and Restructuring team works with directors, shareholders, banks, lenders and creditors to help distressed businesses move into the black. When this is not possible, the team assists with the closure of the business in a way that obtains the best possible result for stakeholders. You will have the opportunity to work with well-regarded industry experts and top-tier clients.

Business Recovery and Restructuring graduates learn to:

- Understand and analyse a wide range of different businesses and industries.

- Meet and correspond with clients and stakeholders, and provide options and recommendations.

- Manage asset realisation processes (including the sale of businesses)

- Analyse financial information, produce financial reports and undertake investigations

- Assist with negotiations and legal matters (including litigation)

- Draft reports for clients (including statutory reports)

- Understand and assist with the management of liquidations, receiverships and voluntary administrations.

- Use a variety of key software products.

Testimonials

"There is a big emphasis on training and further career progression, with ample support on the journey to becoming a chartered accountant, and national trainings with fellow grads on technical and soft skills."

"Baker Tilly offers many training opportunities around the country and I have been able to work with a variety of clients from different industries and locations due to the diverse nature of audit. This exposure is invaluable and definitely a bonus of working in a mid-tier firm."

The support system went beyond what I’d expected and asked for, allowing me to grow professionally. Overall, my time at Baker Tilly Staples Rodway has been full of pleasant experiences.

"The opportunity for career growth flourishes at Baker Tilly, as they are super-willing to help you gain more knowledge and follow the route you wish to take."

"Training is vital for graduates and the training culture at Baker Tilly Staples Rodway is outstanding. They prioritise training, offering extensive sessions not only within your working area but also in other areas such as tax."

"Baker Tilly has been incredibly supportive of my professional ambitions. I expressed interest in doing some audit and tax work. Management were more than accommodating and recently allowed me to complete a two-month audit assignment as well as my normal BAS duties."

"When looking at where to apply after graduation I knew work-life balance was a priority, and I wanted to work with great people in a supportive and fun environment. Baker Tilly really stood out… and as soon as I left the interview I knew that this was where I wanted to work!"

"I have very helpful team members and a buddy. They are always keen to help at any time. Our director and manager are also very helpful and understanding."

"There is a big emphasis on training and further career progression, with ample support on the journey to becoming a chartered accountant, and national trainings with fellow grads on technical and soft skills."

"Baker Tilly offers many training opportunities around the country and I have been able to work with a variety of clients from different industries and locations due to the diverse nature of audit. This exposure is invaluable and definitely a bonus of working in a mid-tier firm."

The support system went beyond what I’d expected and asked for, allowing me to grow professionally. Overall, my time at Baker Tilly Staples Rodway has been full of pleasant experiences.

"The opportunity for career growth flourishes at Baker Tilly, as they are super-willing to help you gain more knowledge and follow the route you wish to take."

"Training is vital for graduates and the training culture at Baker Tilly Staples Rodway is outstanding. They prioritise training, offering extensive sessions not only within your working area but also in other areas such as tax."

"Baker Tilly has been incredibly supportive of my professional ambitions. I expressed interest in doing some audit and tax work. Management were more than accommodating and recently allowed me to complete a two-month audit assignment as well as my normal BAS duties."

"When looking at where to apply after graduation I knew work-life balance was a priority, and I wanted to work with great people in a supportive and fun environment. Baker Tilly really stood out… and as soon as I left the interview I knew that this was where I wanted to work!"

"I have very helpful team members and a buddy. They are always keen to help at any time. Our director and manager are also very helpful and understanding."

A Day in the Life

Find out what a typical working day might look like for our team members, grads and interns...