Tax Talk | Here's your handy Tax Planning Checklist for 31 March 2026

With 31 March approaching, it is the ideal time to consider tax issues and also planning opportunities...

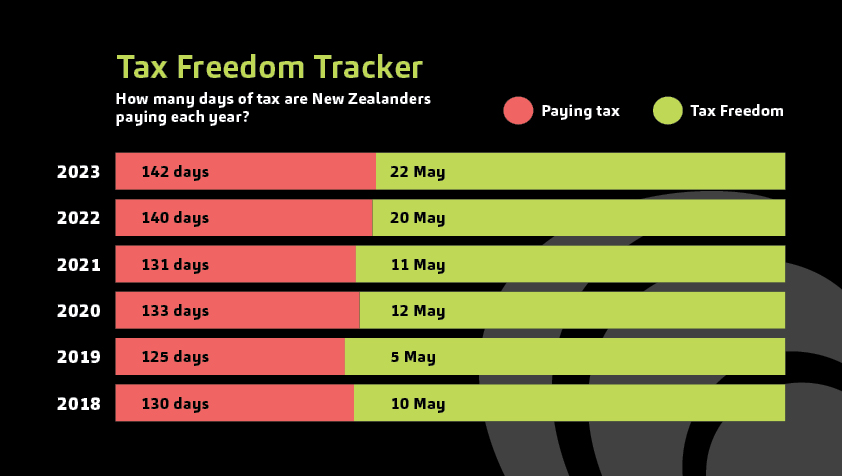

New Zealanders will be paying an extra two days’ worth of taxes in 2023 than last year, according to our Tax Freedom Day calculations.

Time to read: 3 mins

Although the latest figures show a much smaller increase than in 2022, that is likely to come as small comfort for many struggling with the cost-of-living crisis. The GST figures say it all – GST has increased in line with inflation while the personal tax take has gone up 10.5%. Inflation means Kiwis are now paying more tax while seeming to get less for their money.

Tax Freedom Day marks the hypothetical day when New Zealanders have paid off their collective tax bill in full for the year, after which date every dollar they earn is tax-free. The introduction of the top 39 per cent individual tax rate meant last year’s final date of May 20 marked the biggest shift in two decades, with the overall tax take increasing 15 per cent from the previous year.

This year, Tax Freedom Day is forecast to arrive on May 22. Kiwis will spend 142 days paying tax, with the proportion of tax as a percentage of GDP increasing on last year.

“When you add the effects of bracket creep, where workers are pushed into a higher tax bracket by wage increases, more and more Kiwis are seeing their tax bills go up significantly," says Baker Tilly Staples Rodway Christchurch director Spencer Smith.

"Remember that there is a 30% tax on every dollar earned by someone on just $48,000 of annual income, which is less than someone earning the living wage. The concern is that the 33% tax rate that was designed for the highest earners a decade ago is now capturing people across the board, something that’s even more urgent to address during a cost-of-living crisis.”

The Tax Freedom Day calculations also show that Core Crown expenses have risen from $80 billion in 2018 to an estimated $129 billion in 2023. Welfare spending has increased off a pre-Covid base of $26.6 billion in 2020 to an estimated $39 billion for 2023. Meanwhile, while spending has increased across health, education and welfare, there have been growing calls for additional spending to address delivery challenges across all three.

“When you look at the major increase in Core Crown expenses, it’s vital to talk about the value that’s being delivered in these areas, getting the right balance on both tax and government spending. We know that more government spending drives inflation, but also that more Kiwis are reporting hardship or expressing concern about service delivery standards in key areas such as education and healthcare. This makes efficiencies and getting the most for each taxpayer dollar more important than ever,” says Spencer.

This is especially pressing as the government is also seeing the value of every dollar it spends eroded by inflation. The government spent $2.88 billion on finance costs last year, which nearly doubled to $5.67 billion in 2023, adding three more days to New Zealanders’ tax-paying year.

“Coming into an election, with the economy and cost-of-living top of the political agenda, tax could well be a deciding factor in whoever wins the vote. The long overdue issue of tax bracket creep has now reached the point where it cannot continue to be ignored. But moving brackets will be expensive, which inevitably raises the question about our willingness to consider new taxes to offset that cost,” he says.

“There’s no single answer to addressing the fiscal challenge. But, as Tax Freedom Day continues to move out, there’s increasing urgency to ask how we can afford to keep funding increasing government expenditure and how well it is being spent.”

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.