For accounting periods commencing on or after 1 April 2015 all registered charities must prepare financial statements which conform to new financial reporting standards. Many consider this to be the most significant change in financial reporting for the New Zealand charities sector ever. These new reporting requirements include reporting on achievements over the past year and what they cost to deliver. This information is included in a ‘Statement of Service Performance’. It is a fantastic way for charities to let funders, volunteers, recipients and the wider community know more about the charity, what benefits they provide, and why they should be involved.

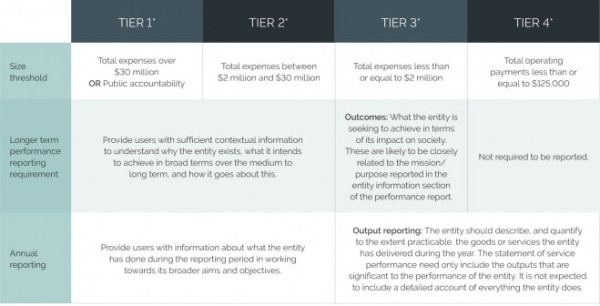

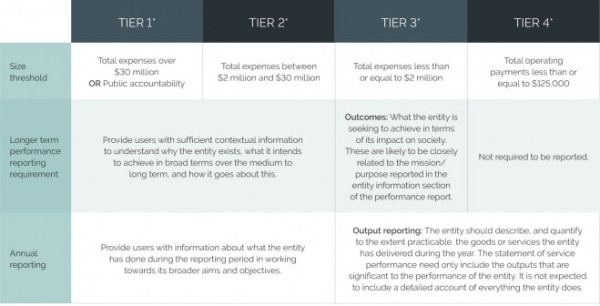

The new reporting requirements differ based on the size of the entity, so that smaller charities, who are often more reliant on volunteer time to prepare their financial statements (known as a Performance Report) and performance information, have less onerous reporting requirements than larger, and often more complex, charities. The mandatory reporting changes have sought to increase accountability for charities, improve quality and communication with the Department of Internal Affairs and to also allow consistent and accurate comparability.

Charities with annual operating expenditure in excess of $2m are required to prepare financial statements which comply with International Public-Sector Accounting Standards (IPSAS) issued by the External Reporting Board (xRB). The requirements of these standards are significantly onerous and consist of 46 individual standards which charities must comply with. In addition to the financial reporting requirements all charities with annual operating expenditure in excess of $1m must be audited by a qualified auditor.

Depending on the level of expenditure there are two options available known as cash accounting and accrual accounting. The main difference between cash and accrual accounting is the timing of when revenue and expenses are recorded. There is a prescribed format for the presentation of the Performance Report for small charities and it is mandatory that this format is used.

According to estimates from the Department of Internal Affairs, over 50% of registered charities, who have operating expenditure of less than $2 million per annum, are not complying with the new financial reporting standards.

All charities with expenditure less than $2m are currently required to include a Statement of Service Performance within their Performance Report. In early November 2017, the External Reporting Board (XRB) released a new accounting standard, PBE FRS 48 Service Performance Reporting. This standard establishes mandatory requirements for Tier 1 and Tier 2 public benefit entities to present service performance information within their annual financial statements. This standard applies for large charities (i.e. more than $2m annual operating expenditure) however does not take effect until 2021, although charities can elect to apply the standard earlier than this, with some large charities already electing to do so. A summary of registered charity performance reporting requirements is provided below:

* All charities default into Tier 1, but may choose to report in another tier if they meet the criteria.

Staples Rodway has extensive expertise in performance reporting and can work with your charity to make sure that you stand out above the rest. When you can demonstrate the value your organisation provides to your community you can attract those with Christmas spirit to reach out and become involved with your charity.