Pathways to the APAC Capital Markets – the complete 2025 guide

Are you planning your next move into Asia Pacific’s capital markets? The guide below is your starting...

Time to read: 1 mins

It is calculated on the basis that the country’s tax bill for the year must be paid first. Only after the tax is paid do those earning the income get to keep it.

This year, Tax Freedom Day was forecast to fall on 7 May, two days later than last year. The government’s increased take from individual taxes and GST is primarily the cause, which appears to be attributable to “bracket creep”, a general increase in incomes and accordingly an increase in spending. It is also likely that an increase in the cost of living is being reflected in the increase in the GST take.

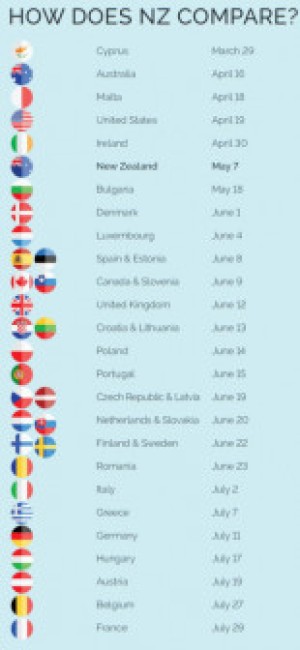

We see Tax Freedom Day as being useful to help advance debate on New Zealand’s tax system. It provides a handy comparison of New Zealand’s tax impost compared with our trading partners in much the same way as the Economist’s “Big Mac Index” is used to compare purchasing power parity. The following table demonstrates New Zealand’s Tax Freedom Day (as calculated by Staples Rodway) compared with other OECD countries, as calculated by various organisations globally, ranked earliest to latest.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.