Changing your business structure from sole trader to a company

Are you a sole trader or a contractor? As your business grows, you may find that you need to employ staff...

Time to read: 3 mins

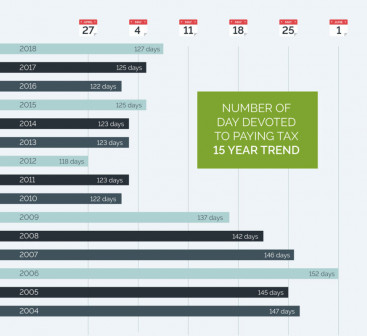

Tax Freedom Day, the hypothetical day that New Zealanders stop working to pay the nation’s tax bill and start working for themselves has arrived two days later this year.

We calculate Tax Freedom Day on the basis that the country’s tax bill for the year must be paid first. Only after the tax is paid do those earning an income get to keep it.

In 2017 Tax Freedom Day was estimated to fall on 8 May, although due to Gross Domestic Product being 1.0% higher than forecast by Treasury, and tax revenue being 0.9% lower, it ultimately fell on May 5.

This year, Tax Freedom Day is forecast to arrive on the 7th of May. The difference compared with last year is down to the government’s increased take from individual taxes and GST. Kiwis will also be paying taxes for a day longer than they would have without the cancellation of the previous government’s tax relief package. If the tax relief package hadn’t been reversed, Tax Freedom Day would have fallen on May 6 this year. What’s encouraging is that the government has indicated it intends to take a sensible approach to spending and avoid incurring significant debt, as well as making no changes to company or individual tax rates.

“Bracket creep”, a general rise in incomes pushing Kiwis into the next tax bracket, and an accompanying increase in spending are the main reason this year’s Tax Freedom Day falls later. An increase in the cost of living is also likely to be a factor, with higher prices spelling higher revenue from GST.

It’s still too early for any steps taken by the new government to influence this year’s Tax Freedom Day. Despite plans to increase fuel tax by as much as 22 cents a litre and the recent announcement that GST would be collected on all online purchases of physical items from overseas, the signs are that the date of Tax Freedom Day will remain stable for the next few years.

While the outcome of the Tax Working Group is unknown, part of its brief is that there be no increase in the rate of income tax or GST. Introduction of any new taxes, such as a capital gains tax, would take several years to directly affect Tax Freedom Day and are unlikely to have much impact compared with GST and income tax.

Tax Freedom Day is much earlier than it was in the early 2000s. Since 2010, Tax Freedom Day has generally fallen in the first week of May. During the last Labour Government, it generally fell in the last week of May, owing to top individual tax rates of 39% (against today’s 33%) and company tax rates topping out at 33% (now 28%).

There is also evidence that companies have taken advantage of changes to provisional tax rules, with key provisional tax due dates seeing substantial decreases in tax revenue.

Tax Director Mr Rudd sees our annual Tax Freedom Day calculations as helping advance debate on New Zealand’s tax system, providing a handy comparison of New Zealand’s tax burden compared with our trading partners in much the same way as the Economist’s “Big Mac Index” is used to compare purchasing power parity.

New Zealand’s Tax Freedom Day is the sixth earliest in the world. By comparison, this year Australia had a Tax Freedom Day of 16 April (five days later than 2017), the United States had a Tax Freedom Day of 19 April (three days earlier thanks to Trump’s tax cuts), the United Kingdom expects its Tax Freedom Day in June and most of the European Union will celebrate theirs in June or July.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.