AI data-crunching supercharges Inland Revenue’s tax net

Instances that commonly went under-the-radar are now easy pickings for Inland Revenue.

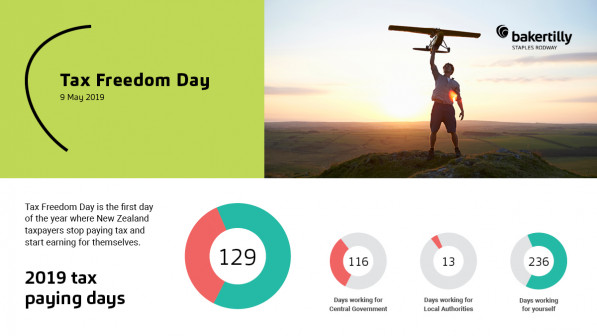

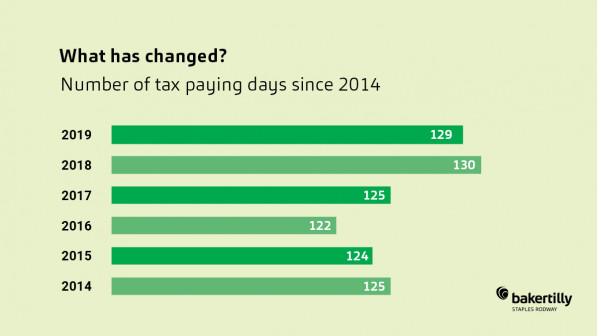

Despite the passionate debate around taxation in recent months, overall Kiwis will actually pay a day’s less tax this year, albeit five more days than two years ago.

Time to read: 4 mins

Each year, Baker Tilly Staples Rodway calculates Tax Freedom Day, the date when all our taxes are theoretically paid and every cent we earn for the rest of the year goes into our own pockets. In 2018, the actual day fell on May 10, three days later than originally forecast, because actual GDP of $274 billion was lower than the expected $282 billion.

“What the numbers do show is that Tax Freedom Day has been pushed back around five days since the Labour Government took control of the purse strings. This is not because of any significant tax increases, but because while tax paid has increased in line with prior years, GDP has not grown at the same rate,” says Mike Rudd, tax director at Baker Tilly Staples Rodway.

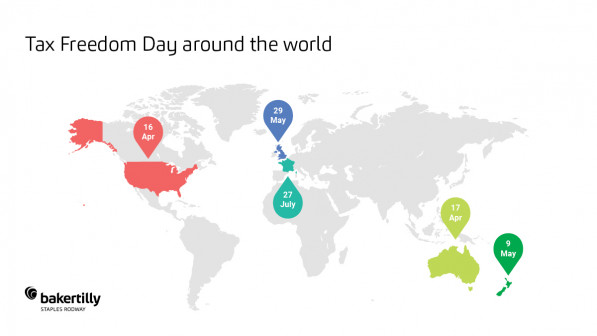

New Zealanders actually have a lower tax burden than many other countries in the OECD, particularly in the European Union, who are more relaxed about taxing to provide government services.

This year the UK falls on May 29 (slightly earlier than last year), with France trailing on July 27, along with many other members of the EU. In the US, it’s Trump’s tax cuts that have helped shift its date back to April 16 far earlier than its typical date around the first week of May. However, this impressive performance is only possible because the US continues to borrow heavily, racking up a trillion US dollars per annum in new debt.

We traditionally compare ourselves to Australia, but their means-tested superannuation generally means the country’s welfare bill is proportionally lower than New Zealand’s, one of the reasons it celebrates tax freedom sooner, on April 17. Bracket creep has been blamed for Australia’s Tax Freedom Day this year falling a day later than last year.

The spectre of “bracket creep” continues to push the tax total up for New Zealanders too, with income tax revenues rising six per cent on last year. As salaries creep up, a higher proportion of Kiwis move into the next tax band, even though some of the wage increase has merely been keeping pace with cost of living increases. The Tax Working Group recommended various adjustments to the tax thresholds but nothing to specifically address this issue.

Meanwhile, local government tax revenues nationwide are up nearly nine per cent on last year, including regional fuel taxes of around $78 million collected by Auckland Council in the first six months since the tax was introduced in July 2018.

“The spike in council revenues really stands out this year. This represents a higher financial burden on businesses and ratepayers, which is concerning. On the other hand, thanks to revenue such as Auckland’s regional fuel tax being spent in a more targeted way on transport infrastructure and road safety, the regions could benefit faster than from more general taxation,” says Rudd.

National excise revenues are also up seven per cent, mainly due to the nationwide fuel tax introduced in September.

It’s difficult to pinpoint exactly how the Tax Working Group’s recommendations and most notably capital gains tax proposals would have impacted on our Tax Freedom Days in the future, especially as these were intended to be part of a fiscally-neutral package. In theory, the proposed tax relief measures, including a reduction in some rates and adjustments to the lower tax bands, could have pulled the date forward. Now that a capital gains tax has been rejected, along with the proposals for amending personal tax rate bands for those earning less than $70,000, the remaining 97 Tax Working Group proposals are unlikely to have a significant effect going forward.

“The rejection of CGT will make the upcoming “Wellbeing Budget” particularly interesting, and the question is whether this will require much extra funding and, if so, where will that come from?” Rudd says.

The calculations used for New Zealand’s Tax Freedom Day are the same as those used around the world by bodies such as the Centre for Independent Studies in Australia and the Tax Foundation in the United States, and the same that we have been using for over 20 years. The global standard does not include government spending.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.