Senior ranks boosted: Congratulations to our five new directors

Our year has got off to a great start with the appointment of five new directors, including one each...

Time to read: 3 mins

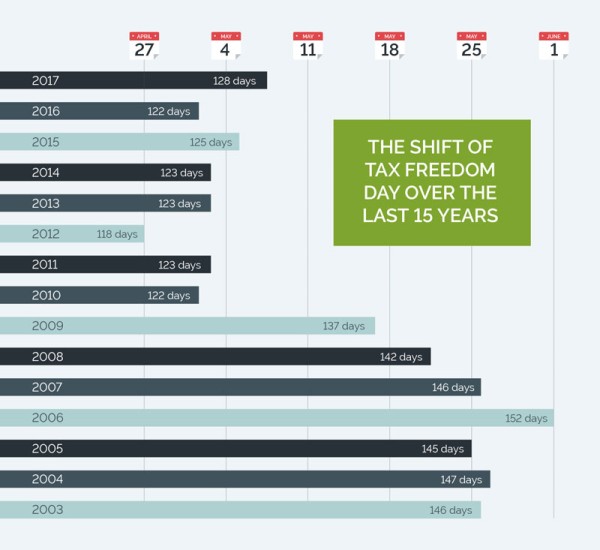

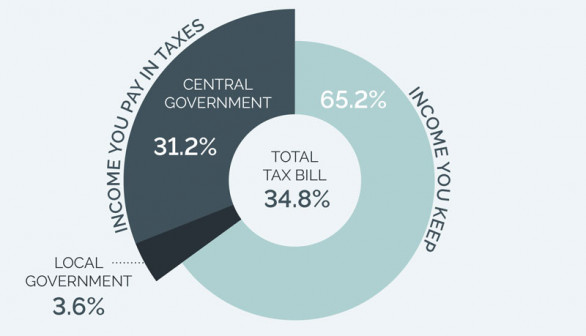

Today marks the day that New Zealanders have collectively paid off their tax bill for the year and can keep the rest of their income for themselves in what has been coined national Tax Freedom Day.

Each year New Zealand we calculate when Tax Freedom Day will fall by analysing GDP, tax revenue and current tax brackets which determine the rate of tax people pay on their income.

This year Tax Freedom Day falls six days later than last year, meaning people are effectively paying more tax than they did in 2016. The total amount Kiwis paid in taxes has increased by 9.5 percent year-on-year, more than double the increase of last year, alongside a 5.1 percent increase in nominal GDP.

Baker Tilly Staples Rodway Director of Tax Mike Rudd says the higher tax bill is reflective of companies turning over higher profits and therefore contributing to growth in government revenue.

“Our methodology shows the true impact of the government on your back pocket each year. Most of the growth in government tax revenue has come from the corporate sector. By the end of February this year, corporate tax collected was already 25 percent higher than in the year to March 2016. In the absence of any major tax changes in the last year, this can only be a sign of a well performing New Zealand economy in spite of uncertainty on the global horizon.”

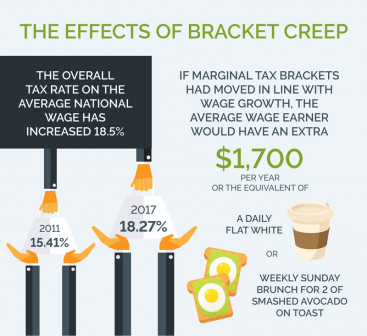

‘Bracket creep’ is also having an impact as a result of inflation pushing wages and salaries into higher tax brackets, leading to a fiscal drag situation. This means that a person earning the average national wage is paying nearly 3% more in tax than they did in 2011. That is, the overall tax rate on the average national wage was 15.41% in 2011 but is now 18.27%, an increase of 18.5%. Had the marginal tax brackets moved in line with wage growth, the average wage earner would have an extra $33 in their pocket per week (or $1,700 per year). Instead, this money has gone to central government.

“We are hearing that the government is considering providing some relief to the taxpayer in this year’s Budget to be announced on May 25. Our hope is that this will include adjusting tax brackets to account for inflation over the past nine years since the last adjustment,” Rudd says.

There are also calls for the government to ensure that tax brackets are adjusted for inflation on a continual basis, something which is expected to receive support from other political parties.

Across the ditch, Australians have higher marginal tax rates and a higher corporate tax rate, although the combination of lower GST (10 percent) and a nil tax threshold, means that the tax burden is lower than that of the New Zealand taxpayer. Australia’s Tax Freedom Day fell on April 13 this year, compared to April 23 for the US.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.