Proven strategies for developing strong teams in the workplace

A high-performing team is a powerful asset in any organisation. However, studies have found that few...

Business leaders, for the most part, seem cautiously confident they will do about the same this year as they did in 2018. Even dairy prices and exports are expected to remain stable. So why is there still so much negativity about the way our economy is heading?

Time to read: 5 mins

Our economy seems to be ticking over fine, with the International Monetary Fund predicting we’ll see 2.5 per cent growth this year. Business leaders, for the most part, seem cautiously confident they will do about the same this year as they did in 2018. Even dairy prices and exports are expected to remain stable. So why is there still so much negativity about the way our economy is heading? Politics is part of the answer, but it’s more to do with trust. With the government’s wellbeing agenda raising the cost of doing business, the major task this year will be convincing business owners they are on

the same page.

Despite the scepticism, the government is actually much more aligned with business priorities than many think. Listening to business leaders, they’re in favour of environmental sustainability and wellbeing measures as long as the overall economy is also in a healthy position. Our research bears this out. In our recent Business Confidence Survey, more than 70 per cent of respondents were in favour of measuring New Zealand’s progress by wellbeing and environmental factors, from mental health and community engagement to air and water quality (see Diagram A).

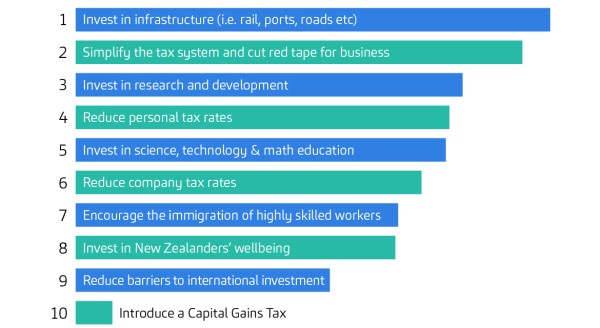

When it comes to what businesses want most, top priorities were infrastructure, a simplified tax system and investment in research and development (see Diagram 1). The encouraging thing is that the government seems well aligned with these demands, from investment in new rail to the 5G network and digital transformation. Business owners I’ve spoken to are delighted that the extensive capital gains tax is no longer on the horizon, a sign that the government, at least in coalition, is listening.

Finance Minister Grant Robertson has already signalled he is willing to take on more debt in order to make the necessary investments from 2022 while keeping to a responsible debt level of no more than 25 per cent of GDP. While this year’s Budget can’t deliver everything on the wishlist overnight, it does seem that government policy and business demands are much more in sync than the old stereotype about Labour Governments would suggest.

Diagram 1: Rank the following issues in order of how much of a positive difference they would make in your business

Baker Tilly Staples Rodway Business Confidence Survey 2019

Despite these signals, our study shows two-thirds of business leaders think overall wellbeing will either remain the same or go backwards, and hope for the economy is also low. This isn’t surprising when you look at house prices. As Kiwis, our optimism seems to be linked to how well our housing portfolios are doing. Aucklanders, in particular, are expecting house prices to drop, largely mirroring views on our economic performance (although Waikato residents are bucking the trend).

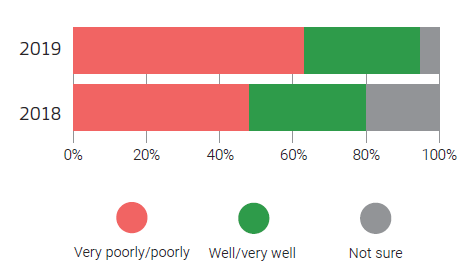

Last year, around half (48 per cent) of business leaders thought the government was performing poorly at managing the economy (see Diagram 2). This has risen to 63 per cent in the current Business Confidence Survey. Only 13 per cent of business leaders believe the economy will grow at the same rate as it did last year, down from 18 per cent in 2018.

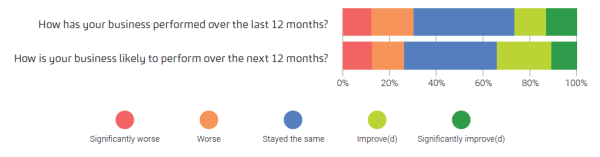

Pessimism about the economy is to be expected during any Labour government – it’s politics. On the other hand, in 2018, the majority of business leaders (68 per cent) believed they personally would be worse off under the new government’s Budget than they were the previous year. This year, only half feel the same. Also a positive sign, survey respondents said their businesses had performed the same (43 per cent) or improved (27 per cent) in the past year (see Diagram 3). My own conversations with business leaders reinforce this. While around half of those surveyed expect job security to worsen, in my experience, businesses are continuing to make investments, consider acquisitions and plan new hires.

Diagram 3: How’s business?

Baker Tilly Staples Rodway Business Confidence Survey 2019

Diagram 2: How is the government performing when it comes to managing the broader NZ economy?

Baker Tilly Staples Rodway Business Confidence Survey 2019

The negativity, therefore, seems to be less about the Budget than the government’s overall agenda. Businesses have already seen significant changes from higher minimum wages to the abolition of the 90-day probation period, domestic violence leave and rising compliance costs, so understandably the business sector is feeling challenged, even though dairy prices and exports are expected to carry on at much the same level as before. While businesses support the concept of wellbeing, the government needs to provide real clarity on how improvements will be paid for.

If the government wants to turn around the negativity, it needs to work harder on demonstrating its alignment with business leaders and ensuring further business costs don’t slow the economy. The figures and our own anecdotal evidence show an acknowledgement that wellbeing is worth paying for, as long as businesses aren’t bearing the full cost.

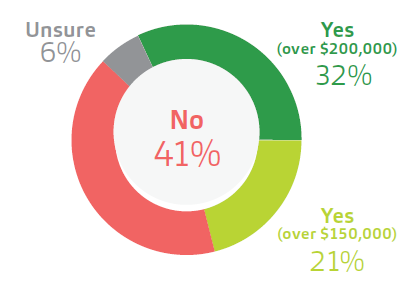

According to the same survey, more than half of business leaders (53 per cent) support a new tax band for very high-income earners. A fifth support higher taxes for those earning more than $150,000 and a third are comfortable with a new threshold at $200,000 (see Diagram 4).

Diagram 4: Do you support a higher top income band for very high earners?

Baker Tilly Staples Rodway Business Confidence Survey 2019

In spite of the fact that this Budget did not include any changes to tax regimes, businesses’ overall sentiment is likely to remain pessimistic unless the government can deliver on its infrastructure programme as well as greater wellbeing without imposing further burdens on the business community. There are encouraging signs that we’re all heading in the same direction, but how we get there will make all the difference.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.