AI data-crunching supercharges Inland Revenue’s tax net

Instances that commonly went under-the-radar are now easy pickings for Inland Revenue.

Time to read: 4 mins

For balance dates commencing from 1 April 2015, the Charities Act 2005 requires that all registered charities submit a report (within 6 months of their year end) that complies with new reporting standards. The standards have been developed:

The reporting standards now determine the information charities need to provide as part of their annual reporting process, which is a legal requirement for all registered charities.

In conjunction with the introduction of these financial reporting standards there has also been an enforced change in relation to assurance requirements. Assurance is the general terminology for all audits, reviews or similar engagements.

Three criteria which may drive assurance requirements

Annual operating expenditure is the Charities day-to-day expenses for the year. Operating expenditure should not include any expenditure on assets such as computers, furniture, equipment, vehicles or purchases of new term deposits.

A qualified auditor is defined within the Financial Reporting Act 2013. In general terms, a qualified auditor must be a chartered accountant and recognised by the Chartered Accountants of Australia and New Zealand (or similar accredited body) as being eligible to act as an auditor.

On at least an annual basis, consideration must be given by Charities to whether an assurance engagement of some sort is required under the above three criteria.

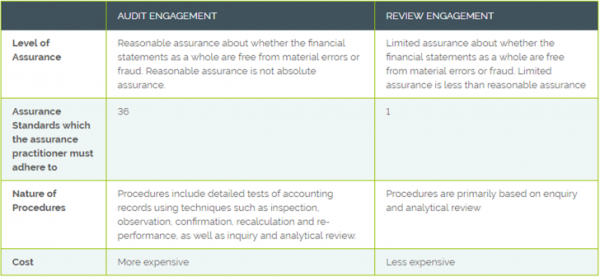

Audits are valuable because they provide a higher level of assurance than a review engagement, however this does make them more expensive, due to the skill, expertise and time required to perform and compliance with onerous statutory frameworks. As a result, the Charities Act only requires the largest entities to have audits (i.e. those with annual operating expenditure in excess of $1m). In order to properly carry out an audit, an assurance practitioner has to comply with 36 International Standards on Auditing. A review, on the other hand, only has one standard that must be complied with. Therefore the level of assurance gained from a review is rightly lower than an audit.

Many older governing documents specify the need for an audit, but this is not necessarily the best value for money for smaller charities. At Staples Rodway we ensure that we work with Charities to determine the best and most suitable engagement with due consideration of the level of assurance and cost effectiveness.

Some funders may be interested to know that the money they have granted to your organisation has been spent for purpose intended. All grant funders have different ‘audit’ or ‘accountability’ requirements that they expect from an organisation. The requirements may also be different depending on the dollar value of the grant income received. Often there is ambiguity in the term ‘audit’ and the funder may be satisfied with something more specific than an audit or review called “agreed upon procedures”. It is recommended that in this instance, organisations have a conversation with their funders and Baker Tilly Staples Rodway.

It is often considered that the main purpose of an audit is to detect fraud. However, the main purpose is to express an opinion over the financial statements of an organisation as to whether the financial statements present a fair representation of the organisation as a whole. It is up to the organisation itself to design suitable, effective internal procedures that would make it hard for fraud to be committed, although it is possible that an audit may pick up some fraud. If your organisation has concerns regarding fraudulent activity or wish to obtain an element of comfort that the controls and systems in place are operating effectively at mitigating the risk of fraud.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.