Pathways to the APAC Capital Markets – the complete 2025 guide

Are you planning your next move into Asia Pacific’s capital markets? The guide below is your starting...

Adapt to changing times but keep your investment fundamentals the same.

Time to read: 4 mins

STORY

Martin Pike

Head of Investments FANZ

The investment world is changing. In the past ten to fifteen years, there have been three significant changes: interest rates have dropped; bond funding durations are increasing; and growth stocks are outperforming values stocks. These are now affecting returns for investors and the risk (or volatility) in these returns.

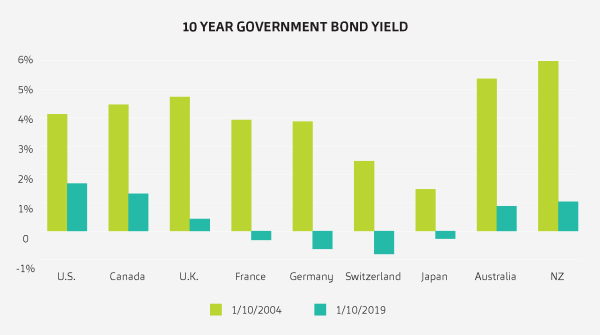

You can see from this data, compiled from publicly available information, the 10-year government bond yields around the world now and 15 years ago.

The return investors were getting from bonds or term deposits previously is nowhere near the low level they are now.

The Bloomberg Barclays U.S. Aggregate Index duration has increased from 4.5 years in 2004 to 6 years in 2019. Over the same period, the yield has fallen from 4.15% to 2.5% (Source Bloomberg Index Services Ltd as at 28/6/19). This means that not only are income yields going to be lower, but the volatility of the securities is likely to increase.

In the last ten years (to Jun 2019), growth shares have outperformed value shares over almost every period. In total, 3.3% per annum better off (using MSCI index data1) with the distribution between the two at its widest now. This is contrary to numerous past studies (notably Fama and French and Warren Buffett) that suggest over the long-term the value approach outperforms growth.

These changes are now making investors think about alternative ways to invest their savings. For example, investors who require a regular income stream have previously achieved this from bank term deposits or direct fixed interest. They used to obtain a consistent income of around 5-8% per annum with a low level of risk. This level of return is now not available for that level of risk. Investors are having to either lower their regular income requirements or, more likely, look for alternative investments to achieve the desired level of income. This can be from high yielding stocks, like property or energy stocks in New Zealand, or higher yielding riskier bonds globally.

Similarly, in this low-interest rate environment, equity investors are looking to invest in megatrends, such as aging populations; rapid urbanisation; or technological breakthroughs. These growth sources are unrelated to cyclical factors and interest rates. When investors look to 2020, there are many ways to capture these changes. However, they must keep to the investment fundamentals:

Diversification can help mitigate investment risk in your portfolio.

Select the right mix of assets to meet your investment objectives.

Particularly valid when markets are down. Stock prices fluctuate more than companies’ fundamentals.

It is more important to stay invested in the markets.

You should review your portfolio at least annually to make sure your asset allocation stays on track.

While some things change, the investment fundamentals remain the same.

FANZ Private Wealth is a boutique investment advisory service who specialise in providing personalised and impartial investment solutions for individuals and trusts. Call 0800 727 2265 to contact an adviser.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

This information is of general nature only and has not been prepared with regard to the needs of any investor. Investors should be aware that future performance may not reflect the historic performance of a fund, and that repayment of any capital or any particular rate of return are not guaranteed. Details are current as at the date of preparation and are subject to change. FANZ Private Wealth is an operating division of Funds Administration New Zealand Limited (FANZ). FANZ is a subsidiary of SBS Bank which is a registered bank. Neither FANZ nor FANZ Private Wealth is a registered bank.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.