Meet Dan he is a perfect example of how investing from a young age was a smart move. His parents kindly started a Kiwisaver growth fund when he was born and deposited $20 a week until he was 18 years old. This amounted to $24,133 (with a 2.9% return after fees, tax and inflation).

However, he didn’t stop there! Dan is smart and knew that once he turned 18 the Government would add $521.43 a year to his pot of money as long as he contributed double that amount. So he continued to add $1,043 a year to his savings, whilst working full time at the gym.

Dan loved working at the gym and had some great clients. One of which was an accountant at Baker Tilly Staples Rodway. Dan told him about his savings account and how he was putting money aside every month to add to it. The accountant was impressed with how savvy he was so gave him some extra advice. “You are earning $17 per hour so you can contribute 3% of your salary which your employer has to match!” Dan couldn’t believe his luck and started this contribution immediately. By the time Dan turned 25 he had $62,828 in his Kiwisaver account.

Dan enjoyed going out with his friends, playing rugby and travelling. He worked some long hours at the gym to fund his OE and had his own car. Dan flatted with some friends but longed for a house of his own. He went back to see his friend at Baker Tilly Staples Rodway and found out that he could withdraw his savings. “Anyone in a Kiwisaver scheme for 3 years can withdraw their contributions, their employer’s contributions, government yearly contributions and any earnings made on the investment to put towards a deposit on their first home, as long as they leave $1,000 in the Kiwisaver fund.” He told Dan.

Dan contacted Kiwisaver and withdrew his money for the deposit of a small flat in town. “I wonder what I could have achieved if I’d have put $40 a week into my savings?” He thought to himself.

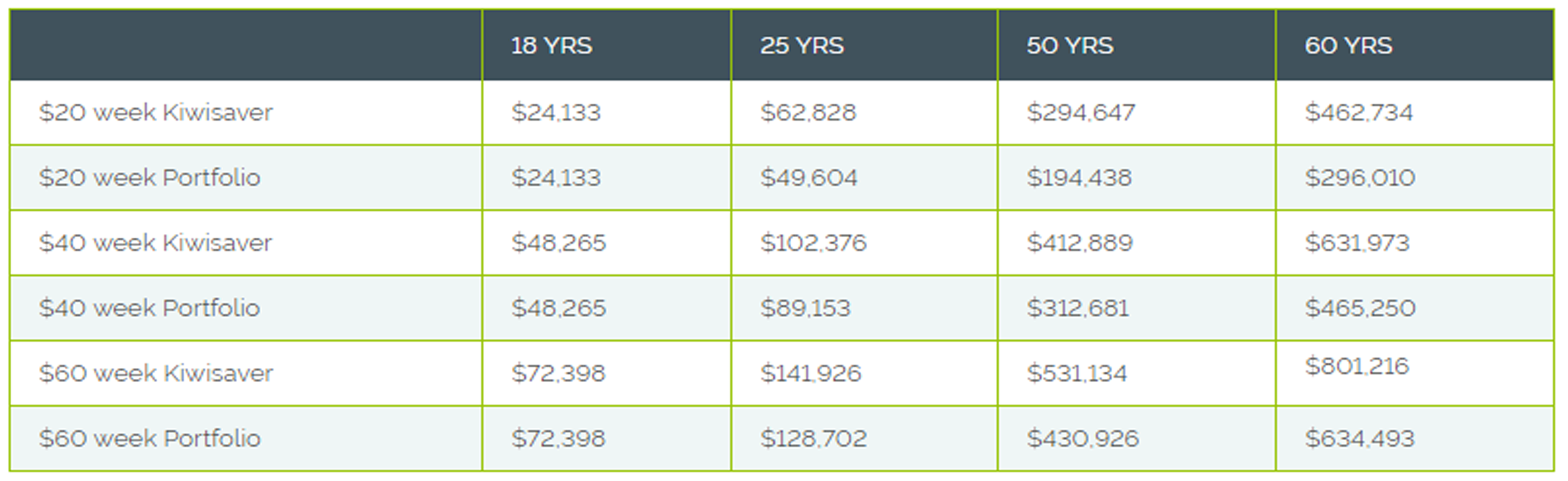

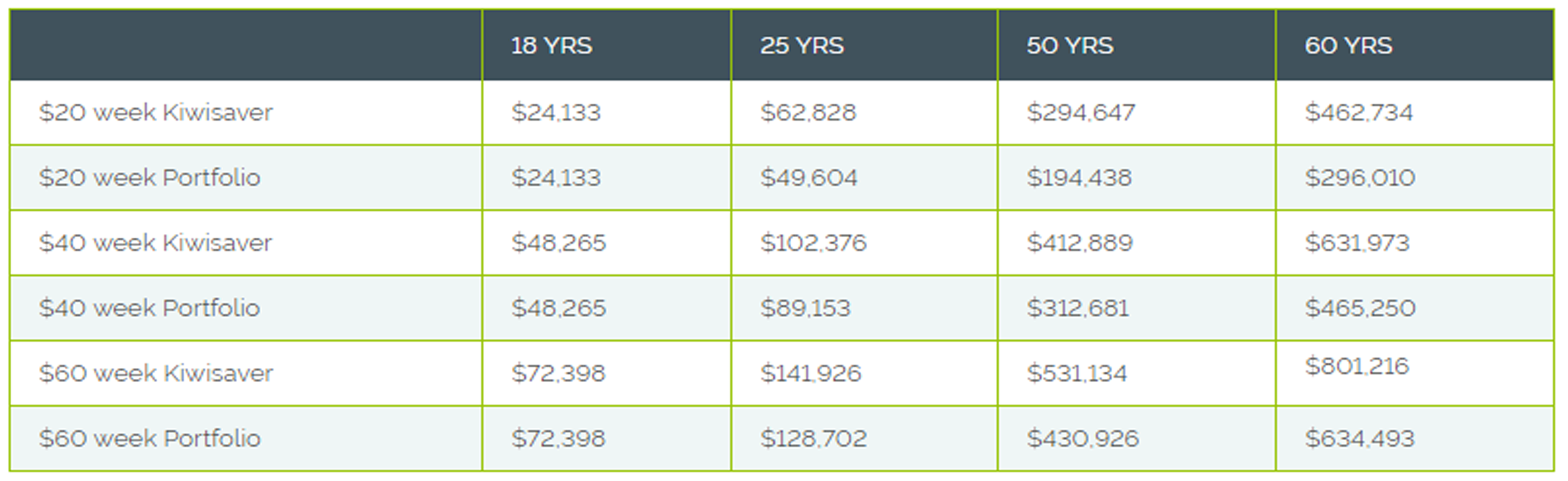

Here are the various amounts Dan could have saved by the age of 25:

Small steps now help in the future

If you are a parent wanting to support your child in making smart financial decisions, here are some tips to teach financial life skills:

- Encourage children to start saving SMALL amounts when they are young (saving pocket money for bigger purchases)

- Open a savings account for your child at your local bank, discuss with your child how they can earn interest and watch their money grow.

- Encourage your child’s school to talk about savings and investments and everything in between (e.g. one example is software that Kendall Flutey has designed called Banqer. This software simulates online banking for use in the classroom, providing hands on learning for kids to develop confidence with money)

What can you do to help

Do your research and utilise the tools on offer to support you. Most banking websites have calculators that help you work out how much your child will need to save to reach a savings goal and how long it will take, along with different ways to save with the bank, whether it is in a savings account, PIE fund, or term deposit. Banks have different packages available for those parents wanting accounts for kids, school leavers, graduates, those buying homes and senior citizens.

Better education would lead to higher national savings and lower debt in the future, so let’s keep the conversation going. If you’re still unsure, we’ll be posting helpful tips on our Facebook page throughout Money Week.

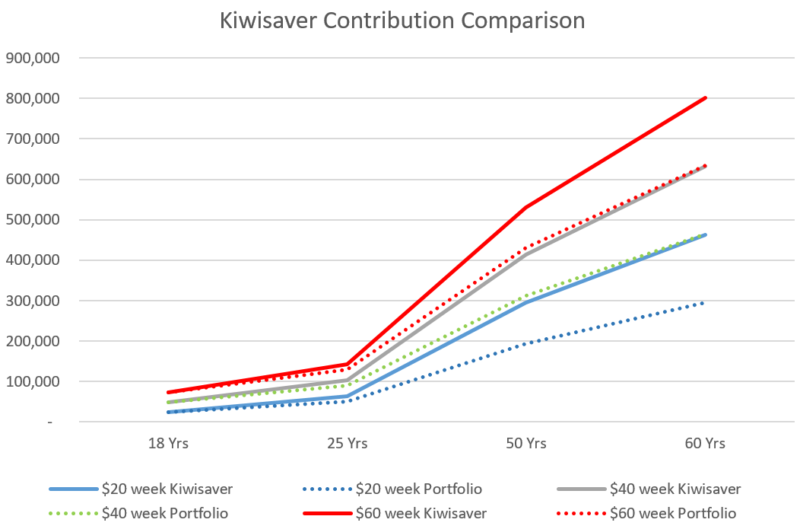

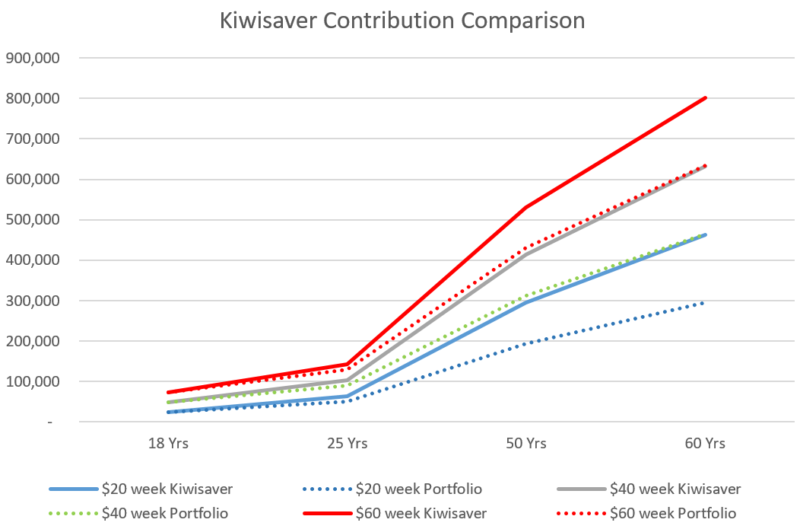

The graph above shows how your funds can accumulate over time. The graph shows the funds accumulated if you deposited $20, $40 or $60 a week into a Kiwisaver fund. The dotted lines show the funds accumulated if you did not invest in a Kiwisaver fund but deposited your funds ($20 week and 3% of your earnings) in a growth portfolio fund instead (with the same return mentioned above). Your fund contributions would not include your employer contributions or the government contribution.

This clearly shows the savings potential by taking advantage of the government and employer contributions. At age 60 if you contributed $60 a week plus your earnings (on the assumptions above) into a growth Kiwisaver fund you would have $801,216 compared with $634,493 that you would have in a growth portfolio fund.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.