Tax Talk | How New Zealand’s tax changes and rates will affect you

With the government’s tax cuts less than a month away from coming into force, we briefly outline what...

With cases in the community expected to hit their peak in the coming weeks, more people are being required to self-isolate.

Time to read: 6 mins

Note: This article was updated on 11 March 2022. For the latest updates on isolation rules please check here.

We are now in Phase 3 of the government’s response to Omicron, which has brought changes to the criteria of who needs to isolate as well as to isolation periods and testing protocols. Here we have put together some general guidance for employers around managing self-isolation in the workforce at this phase and what government assistance is available. It is important that businesses continue to assess the potential impact of isolation on their workforces.

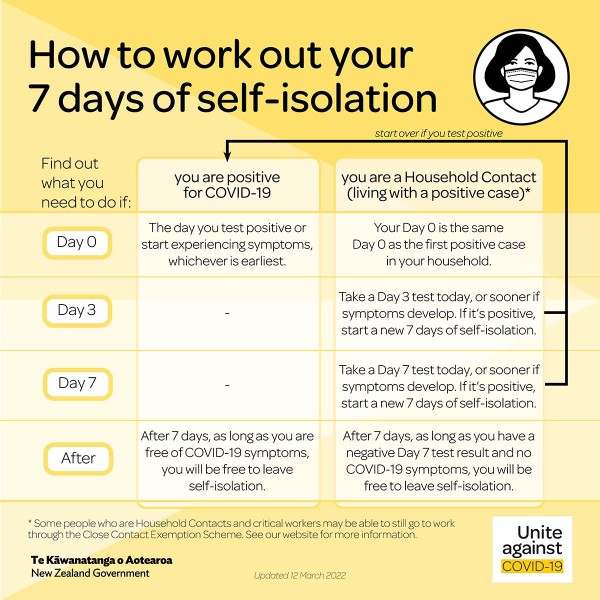

Image from Unite against COVID-19, updated 12 March 2022

The current requirements are:

The isolation periods above came into effect at 11.59pm on 11 March 2022 and there may be pressure for the Government to reduce these further in the future.

Employers have access to the following two government support schemes to help pay employees who are required to isolate. In doing so they have to complete a Declaration which requires they meet certain obligations.

COVID-19 Short-Term Absence Payment

This scheme changed recently with the use of Rapid Antigen Tests (RATS) being adopted as the primary means of identifying positive cases. In short, you cannot get the Short-Term Absence Payment when your employee takes a RAT because the results are almost immediate (approximately 20 minutes). If your employee tests positive you will be able to apply for the Leave Support Scheme.

So, eligibility for this payment ($359 for an affected employee) is now very limited.

COVID-19 Leave Support Scheme

At the time of writing there were no changes to the qualification requirements for the Leave Support Scheme on the Work and Income website despite the move to Phase 3. The Government announced on 9 March that Leave Support Scheme payments will be weekly given the new reduced isolation periods.

The following is based on the scheme as it stood on 11 March and employers should keep checking here for changes.

The Leave Support Scheme provides a weekly payment of $600 for full time employees (20-plus hours per week) and $359 for part time employees (up to 20 hours per week) who are required to isolate for at least four consecutive days due to:

Given the Phase 3 requirement for household contacts of positive cases to isolate one would logically assume this scheme applies to employees in this category however at the time of writing the website did not state this.

It is important to remember that these schemes are there to help employers retain staff and when applying you do have to be conscious of the commitments you make when signing the declaration. They include that you will, for the period you receive the subsidy:

There has been some confusion around how the government subsidies relate to any leave the employee may take while isolating when they are unable to work. This is because there is often a gap between the ordinary salary or wages a person can earn during the isolation period and the amount of ordinary salary or wages the subsidy might cover.

There are some general "rules of thumb" that employers should consider:

When it comes to the use of leave to cover any part of the isolation period the Declaration does set parameters on what you can do. The most relevant commitments are:

In essence you can agree with your employee whether they use annual leave or other leave, but you cannot compel them to do this outside of any legislative requirement. Every situation can be different so we recommend you get advice about the approach you take.

As mentioned above, employers must sign a declaration as part of their application for either of the support schemes. By signing the declaration, you acknowledge and agree that:

For more detail, links to each of the declarations are below.

Short-Term Absence Payment Declaration

Leave Support Scheme Declaration

It is important you do not breach any of the Declaration requirements.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.