AI data-crunching supercharges Inland Revenue’s tax net

Instances that commonly went under-the-radar are now easy pickings for Inland Revenue.

If you help run a not-for-profit or charity organisation that reports using Tier 3 (less than $2 million expenses per annum) or Tier 4 (less than $140,000 expenses per annum), then changes to your external reporting standards are on the way. René Lamprecht clarifies…

Time to read: 8 mins

The External Reporting Board (XRB) is proposing amendments to simplify and improve the Tier 3 and 4 Public Benefit Entities (PBE) standards in response to the feedback received as part of the post-implementation reviews. Consultations are currently open for all stakeholders to consider the proposed amendments and provide feedback.

PBE FRS-48 requires PBEs to “tell their story” in reporting service performance information. Changes proposed include:

Simplified accounting requirements have been proposed for PBEs that choose to revalue certain assets, including allowing:

The Tier 3 standards currently require PBEs to opt up to Tier 1 and 2 standards in certain areas.

| Proposed Tier 3 (NFP) revenue categories | Proposed Tier 3 (NFP) expenses categories |

| Donations, koha, bequests, and other general fundraising activities | Expense related to public fundraising |

| Grants (excluding service delivery grants, contracts) | Employee remuneration |

| Capital gains | Volunteer and other employee expenses |

| Funding from service delivery grants/contracts (government) | Expenses related to sale of goods or services (commercial activities) |

| Funding from service delivery grants/contracts (non-government) | Other expenses related to the delivery of entity objectives |

| Sale of goods or services (commercial activities) | Grants and donations made |

| Membership fees and subscriptions | Other expenses |

| Interest, dividends, and other investment revenue | |

| Other revenue |

| Proposed Tier 3 (PS) revenue categories | Proposed Tier 3 (PS) expenses categories |

| Donations, koha, bequests, and other general fundraising activities from the public | Expense related to public fundraising |

| Grants from non-government organisations | Employee remuneration |

| General funding received from central or local government | Other employee-related expenditure |

| Revenue from service delivery grants/contracts (central or local government) | Expenses related to commercial activities |

| Revenue from service delivery grants/contracts (non-government) | Other expenses related to the delivery of entity objectives |

| Revenue from commercial activities | Grants and donations |

| Interest, dividends, and other investment revenue | Other expenses |

| Other revenue |

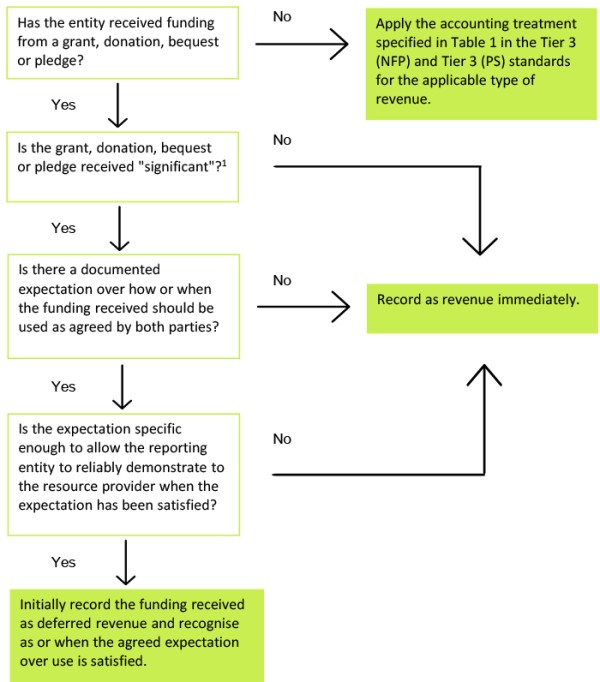

Increased flexibility in recognising grant, donation, bequest and pledge revenue is proposed. This includes:

1 As per the graph above, items are “significant” if their omission or misstatement could, individually or collectively, influence the decisions or assessment of users relying on the performance report. Significance is considered in relation to both the nature and size of the item, or a combination of both

Increased transparency over the reasons for retaining accumulated funds is proposed, including:

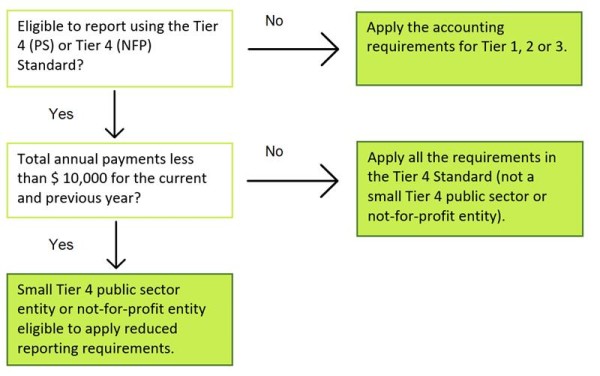

Reducing complexity to meet user needs and promote increased adoption. Proposed changes include:

To better meet the needs of smaller public sector entities it is proposed that all requirements marked with a triangle cross symbol are removed, such as the requirement to include:

Please refer to Tier 4 (NFP) Standard Exposure Draft and Tier 4 (PS) Standard Exposure Draft.

New and updated guidance has been proposed to help Tier 4 entities “tell their story”. This includes:

It is proposed that this Statement is no longer required, although certain disclosures would still be required, such as:

It is proposed that additional categories are included and existing categories are clarified, including:

| Proposed Tier 4 (NFP) cash received categories | Proposed Tier 4 (NFP) cash paid categories |

| Donations, koha, bequests and other fundraising activities | Fundraising costs |

| Grants received (excluding service delivery grants/contracts) | Employee remuneration |

| Funding from service delivery grants/contracts | Volunteer and other employee costs |

| Sales of goods or services (commercial activities) | Costs related to sale of goods or services (commercial activities) |

| Membership fees or subscriptions | Other costs related to delivery or entity objectives |

| Interest or dividends received | Grants and donations paid |

| Other cash received | Other cash paid |

| Proposed Tier 4 (PS) cash received categories | Proposed Tier 4 (PS) cash paid categories |

| Donations, koha, and bequests from the public | Fundraising costs |

| Grants from non-government organisations | Employee remuneration |

| General funding received from central or local government | Other employee costs |

| Revenue from service delivery grants/contracts | Costs related to sale of goods or services (commercial activities) |

| Sales of goods or services (commercial activities) | Other costs related to delivery or entity objectives |

| Interest or dividends received | Grants and donations paid |

| Other cash received | Other cash paid |

The proposed effective date in both the Tier 3 and Tier 4 Exposure Drafts is accounting periods beginning on or after 1 April 2024, with early adoption permitted. This date is tentative and would be reviewed before issuing the final standards.

The proposed changes are a positive step in making it easier for not-for-profit and public sector entities to meet their reporting requirements.

For more information on what is required, please contact your local Baker Tilly Staples Rodway representative.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.