To audit or not to audit: That is the question for registered charities

Every registered charity in New Zealand faces the question of whether they ought to be audited. Let’s...

For accounting periods commencing on or after 1 April 2015 all charities, must prepare financial statements which conform to new financial reporting standards. Many consider this to be the most significant change in financial reporting for New Zealand’s charities sector ever.

Time to read: 1 mins

The mandatory reporting change has sought to increase accountability for charities, improve quality and communication with the Department of Internal Affairs and also allow consistent and accurate comparability.

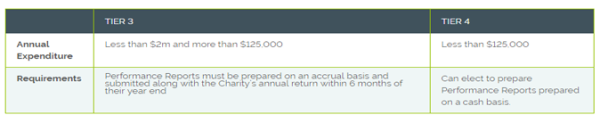

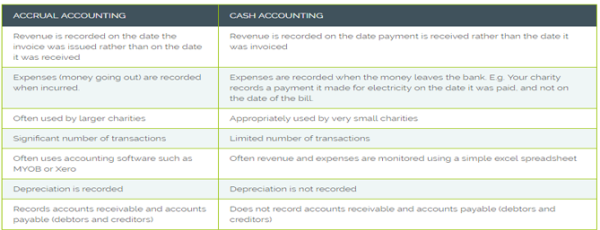

This article will help Charities with annual expenditure under $2m to understand their obligations with regards to Simple Format Reporting and the preparation of their ‘Performance Report’. There are two options available known as cash and accrual. The main difference between cash and accrual accounting is the timing of when revenue and expenses are recorded.

To understand more about a charities obligation with regards to preparing Performance Reports, the following table is a guide to the difference between accrual and cash accounting:

If you would like further assistance regarding Tier 3 and Tier 4 financial reporting or any other not-for-profit reporting matter please contact our Not-For-Profit expert David Goodall on 06 757 3155 or via email david.goodall@staplestaranaki.co.nz

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.