Staples Rodway Pre-Budget 2018

Question 1

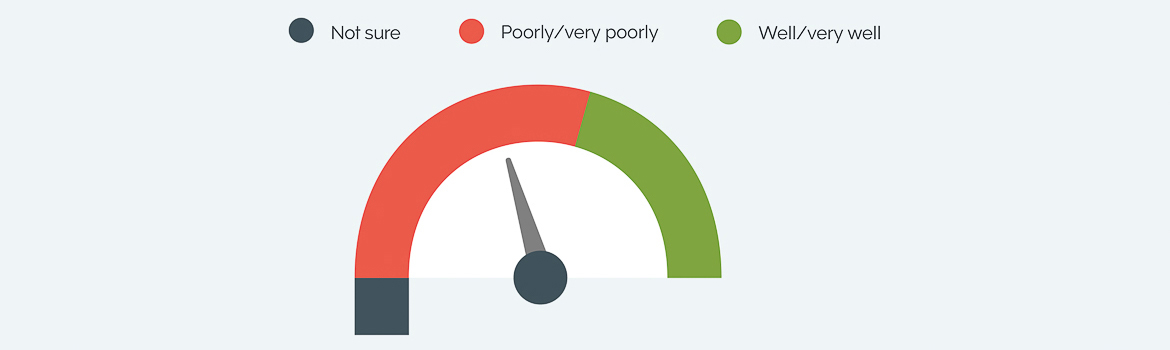

How is the government performing when it comes to managing the broader New Zealand economy?

| Very well / well | Poorly / very poorly | Not sure |

|---|---|---|

| 32.43% | 47.91% | 19.67% |

Question 2

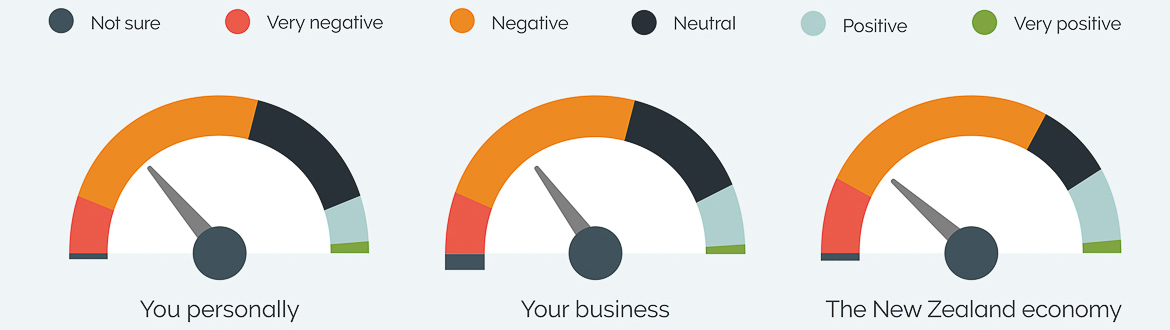

Thinking specifically about this year's upcoming budget, do you think it will have a positive or negative impact on:

| Very positive | Positive | Neither positive or negative | Negative | Very negative | Not sure | |

|---|---|---|---|---|---|---|

| You personally | 1.88% | 7.95% | 30.33 | 47.49% | 9.83% | 2.51% |

| Your business | 1.50% | 10.30% | 26.61% | 45.06% | 10.30% | 6.22% |

| The NZ economy | 2.10% | 13.24% | 16.18% | 51.89% | 13.45% | 3.15% |

Question 3

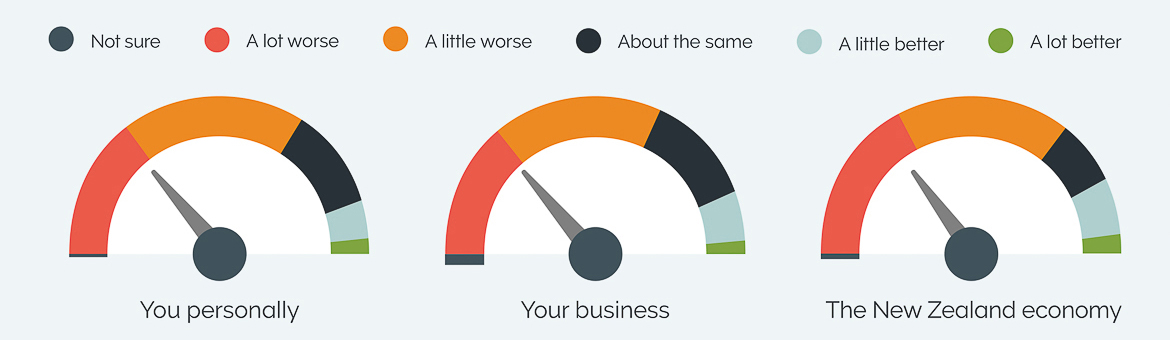

Do you expect this year's budget to be better or worse than last years budget for:

| Much better | A little better | About the same | A little worse | A lot worse | Not sure | |

|---|---|---|---|---|---|---|

| You personally | 2.52% | 6.71% | 20.96% | 40.88% | 27.46% | 1.47% |

| Your business | 2.15% | 8.58% | 22.75% | 36.70% | 25.32% | 4.51% |

| The NZ economy | 3.18% | 10.38% | 13.35% | 38.35% | 32.42% | 2.33% |

Question 4

How important is it for the government to balance the budget?

| Very important | Somewhat important | Not so important | Not at all important | Not sure |

|---|---|---|---|---|

| 48.12% | 40.38% | 9.62% | 1.67% | 0.21% |

Question 5

If you had to choose one thing that government could do in the upcoming 2018 budget to facilitate an environment where your business could succeed and grow, what would that be?

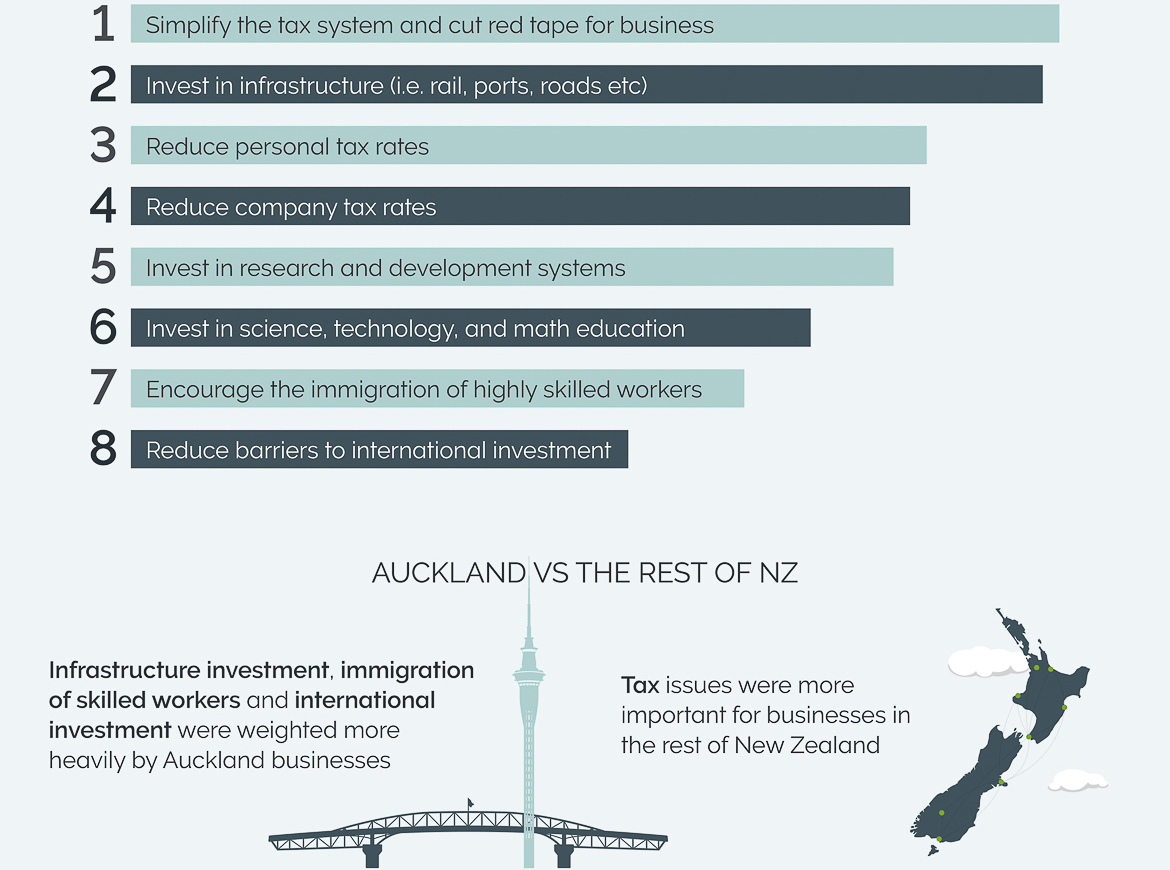

Question 6

Here are some things that other businesses have said government could do to create a better environment for business growth. Rank the following issues in order of how much of a difference they’d make to your business.

| Rank | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| Simplify the tax system and cut red tape for business | 30.54% | 14.23% | 12.97% | 11.30% | 9.83% | 9.41% | 6.28% | 5.44% |

| Reduce company tax rates | 13.18% | 19.04% | 12.76% | 10.04% | 10.25% | 9.83% | 14.85% | 10.04% |

| Reduce personal tax rates | 15.90% | 14.64% | 15.90% | 7.74% | 10.04% | 13.60% | 10.67% | 11.51% |

| Invest in research and development systems | 5.44% | 12.97% | 14.64% | 19.04% | 19.46% | 13.60% | 8.58% | 6.28% |

| Invest in infrastructure (i.e. rail, ports, roads etc) | 19.87% | 15.90% | 16.53% | 16.11% | 14.02% | 8.58% | 5.02% | 3.97% |

| Encourage the immigration of highly skilled workers | 4.18% | 7.95% | 10.25% | 11.30% | 13.39% | 17.99% | 19.46% | 15.48% |

| Invest in science, technology, and math education | 6.69% | 10.25% | 12.13% | 14.85% | 11.30% | 15.27% | 20.92% | 8.58% |

| Reduce barriers to international investment | 4.18% | 5.02% | 4.81% | 9.62% | 11.72% | 11.72% | 14.23% | 38.70% |

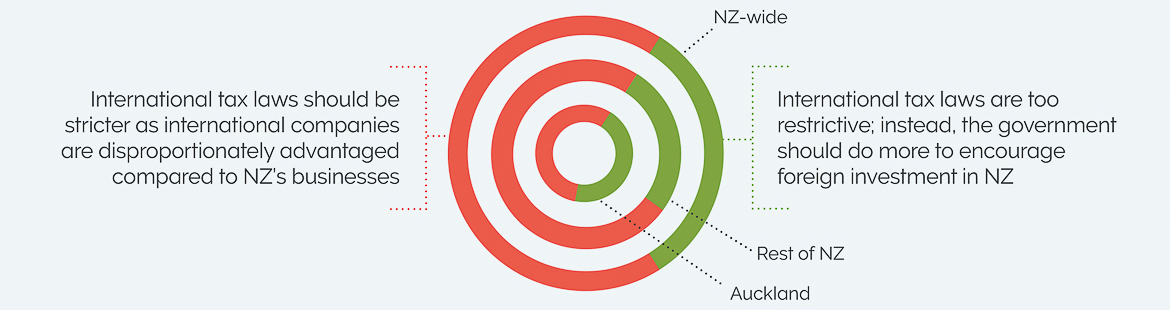

Question 7

Some people have advocated for greater foreign investment and trade, while others think that there is already too much foreign influence in New Zealand business. One way governments try to balance the level of foreign investment with support for local business is through tax law. Which of the following statements do you think is a better description of New Zealand's tax laws for international companies?

| International tax laws are too restrictive; instead, the government should do more to encourage foreign investment in New Zealand | International tax laws should be stricter as international companies are disproportionately advantaged compared to New Zealand’s businesses |

|---|---|

| 31.97% | 68.03% |

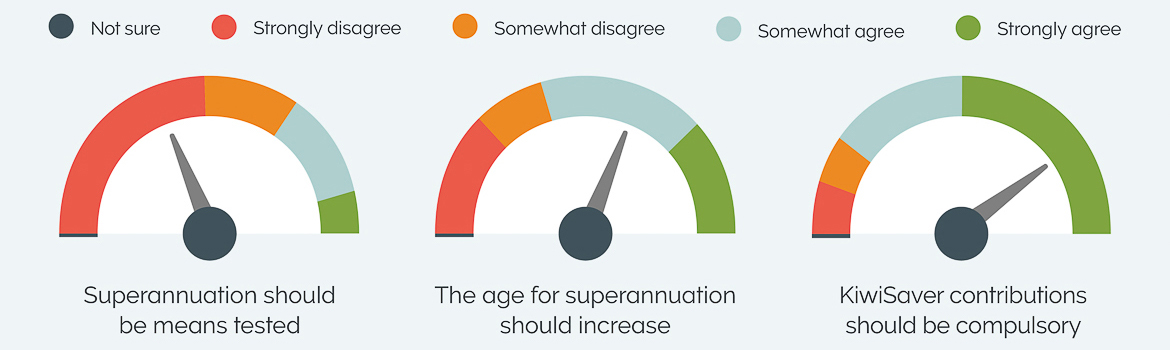

Question 8

We’d also like to ask specifically about superannuation. What is your level of support for the following statements?

| Strongly agree | Somewhat agree | Somewhat disagree | Strongly disagree | Not sure | |

|---|---|---|---|---|---|

| Superannuation should be means tested | 7.17% | 21.73% | 21.31% | 48.31% | 1.48% |

| The age for superannuation should increase | 21.99% | 37.21% | 15.64% | 23.68% | 1.48% |

| KiwiSaver contributions should be compulsory | 49.05% | 30.95% | 9.26% | 9.05% | 1.68% |

Question 9

What do you expect the following economic indicators to do over the next year?

| Increase a lot (5) | Increase a little (4) | Stay about the same (3) | Decrease a little (2) | Decrease a lot (1) | Not sure | Sentiment (3-neutral) | |

|---|---|---|---|---|---|---|---|

| NZ economic growth forecasts | 1.69% | 16.46% | 25.74% | 41.56% | 13.29% | 1.27% | 2.48 |

| Consumer confidence | 1.27% | 12.29% | 23.31% | 45.55% | 17.16% | 0.42% | 2.34 |

| Business confidence | 1.69% | 9.09% | 14.38% | 46.51% | 27.48% | 0.85% | 2.08 |

| International investments | 1.05% | 8.02% | 28.48% | 34.60% | 24.47% | 3.38% | 2.16 |

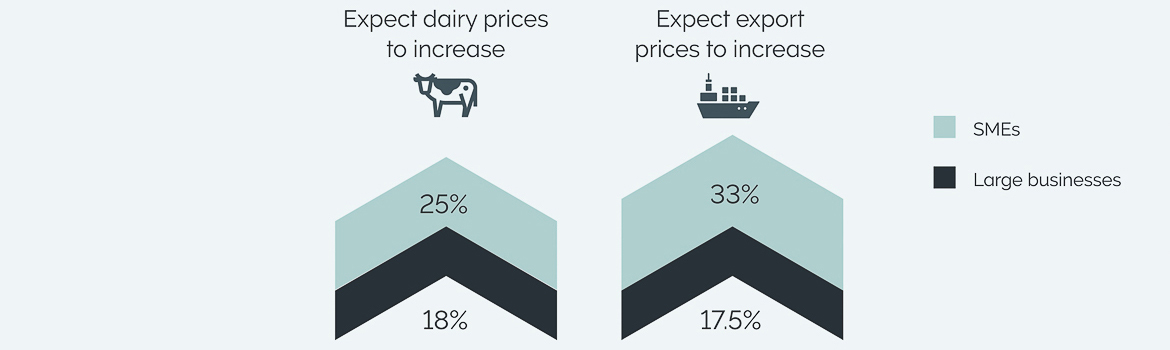

| Exports | 2.33% | 27.48% | 44.82% | 18.82% | 4.65% | 1.90% | 2.98 |

| Dairy prices | 1.48% | 22.57% | 49.58% | 19.20% | 2.32% | 4.85% | 2.87 |

| Job security | 0.85% | 14.80% | 38.48% | 34.25% | 10.99% | 0.63% | 2.58 |

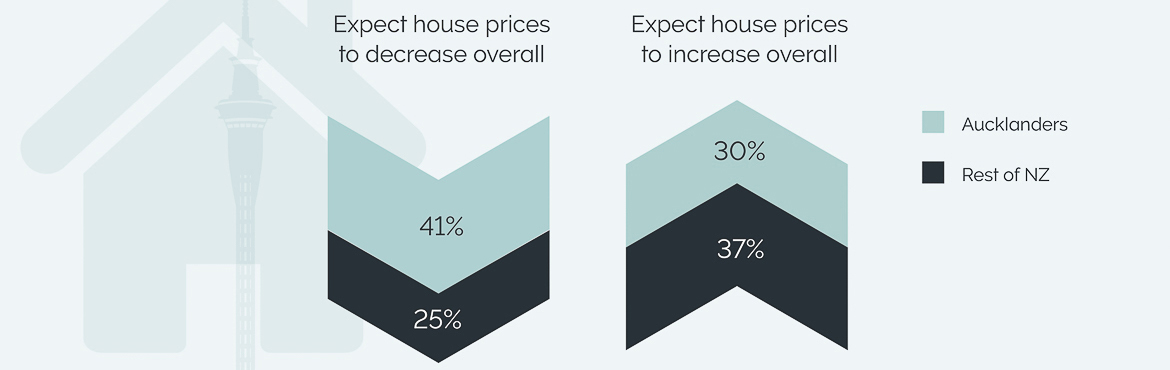

| House prices | 5.91% | 29.75% | 34.39% | 24.89% | 4.01% | 1.05% | 3.05 |

Key Findings

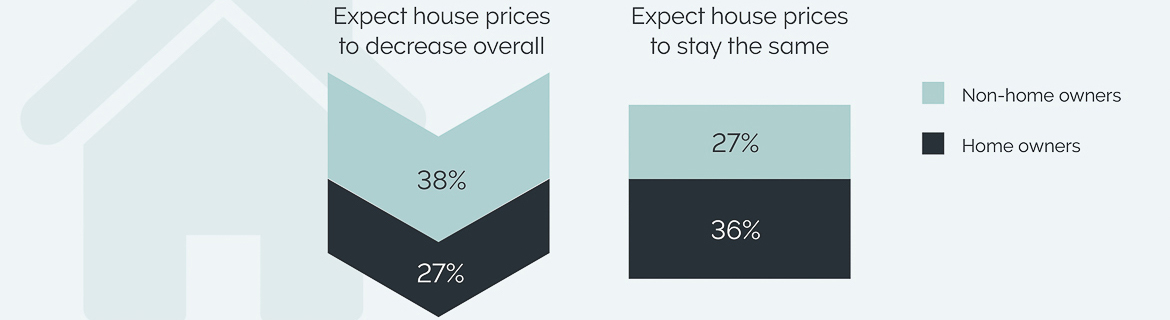

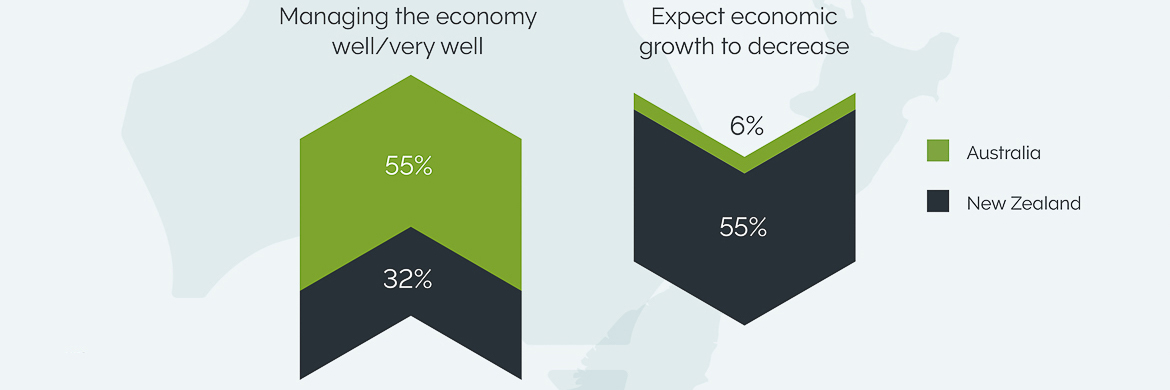

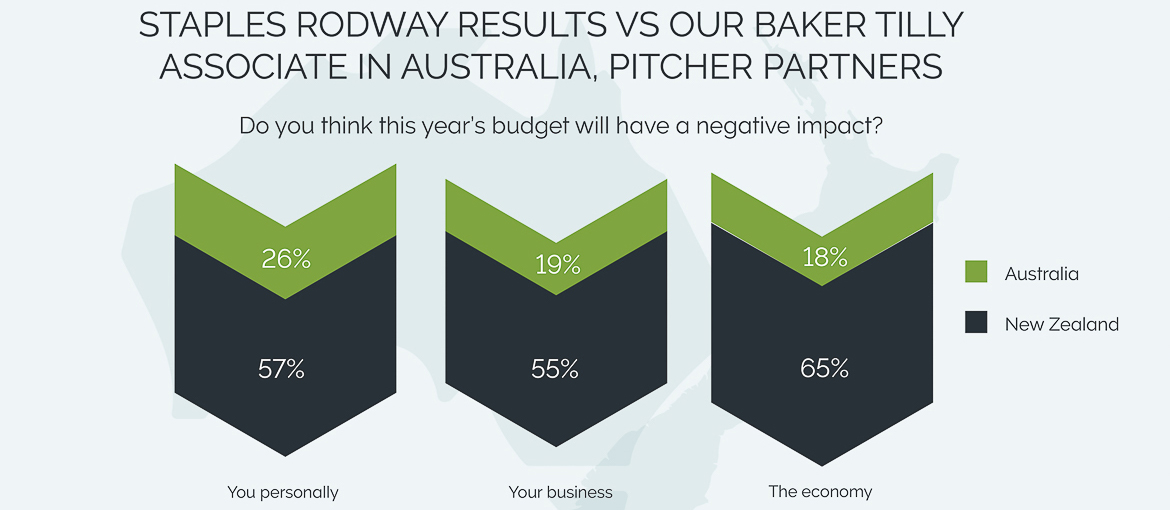

| Finding | NZ | AU |

|---|---|---|

| Managing the economy well or very well | 32% | 55% |

| Budget will have a negative impact on you | 57% | 26% |

| Budget will have a negative impact on your business | 55% | 19% |

| Budget will have a negative impact on the economy | 65% | 18% |

| Economic growth decrease | 55% | 6% |

The sample