Changing your business structure from sole trader to a company

Are you a sole trader or a contractor? As your business grows, you may find that you need to employ staff...

Time to read: 4 mins

All eyes are on the Gold Coast to see which athletes will come up trumps in the Commonwealth Games. Looming in the background, the accounting profession is on the start line of the most significant event in financial reporting this decade the implementation date for the three new financial reporting standards affectionately known as the ‘Big 3’.

These standards have a truly international reach, which means they will impact New Zealand businesses in much the same way as businesses in Australia, the United Kingdom, South Africa and Uganda. Businesses across the Commonwealth are lined up on the start line to implement these standards = are you and your team ready? Or let’s put it another way can you afford to not be ready? Is opting out of starting this event a valid option? Something along the lines of ‘well I know I signed up to do this event but I’ve got a bit of a calf strain at the moment and don’t want to push it, I think I’ll do it next year instead’. If your business is required to prepare financial statements in accordance with Tier 1 or 2 international financial reporting standards (IFRS) then, no, coming up with some terrible, yet believable, excuse is not a valid option. You must get ready to race, or comply, and you must do so soon.

For businesses at the bigger end of town, the FMC Reporting Entities, (aka the professional athletes of the business world) the FMA have publicly stated that they are considering the impact of these new standards and will be engaging with auditors and entities themselves to discuss how financial statements should be prepared. In other words, the spotlight is on. Not quite random drug testing, but you should make sure that you and your business are ready to comply.

Like with any event the really hard work is done in advance, in the training phase. Assessing your revenue contracts for performance obligations, reviewing your lease contracts to determine whether the significant risks and rewards lie with you, or with the firm you are leasing the asset off, and lucky last considering whether you have any financial instruments that have been impaired and expected credit losses that to be written down. Financial instruments are the bacteria of the financial reporting world we all have them, we just don’t want to admit it. But are they that bad? No, like bacteria financial instruments are a necessary part of a healthy and functioning system. A healthy dose of financial instruments enables your business to operate and the truth is they really can’t be avoided. Funds held in the bank, debtors, creditors, shares in other entities, these are all financial instruments, so you don’t need to be involved in complex hedging transactions to be impacted by this standard. The same can be said about revenue. Not many businesses will survive without a steady income source revenue is very much the oxygen of the athletic world.

The implementation of these standards is phased, which means you do not have to train for all three at once. You can focus on assessing and refining your systems relating to measuring your revenue and financial instruments now and worry about leases next year. Is this the best approach? My common response to this type of question is, it depends. It depends on how ‘material’ leases are to your business and whether or not you expect the new leases standard to have a significant impact on your financial statements. If not, then heck, why not adopt all the standards now. There is then no need to develop a separate training regime/implementation plan next year.

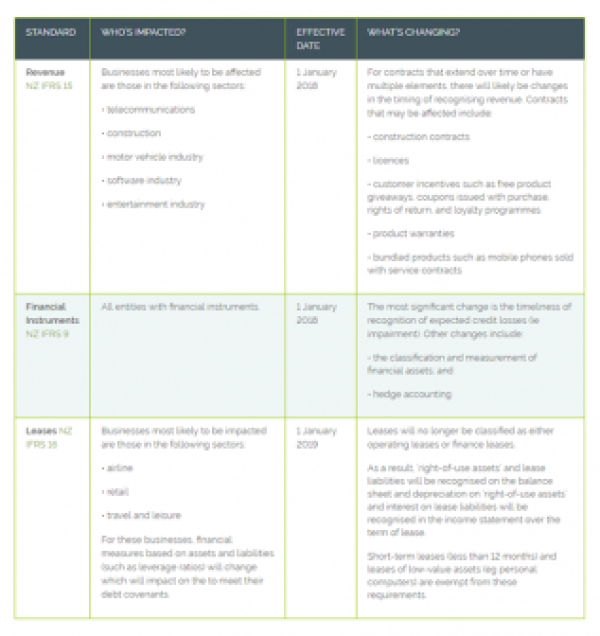

We all know the start date of the Commonwealth Games. What are the start dates for these new standards and what’s required?

So what are you waiting for? Don’t turn up to the start line unprepared get your training plan sorted now. Your local Staples Rodway business advisor can help if you need a steer in the right direction. We have coached many businesses to success and would love to help yours too.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.