Changing your business structure from sole trader to a company

Are you a sole trader or a contractor? As your business grows, you may find that you need to employ staff...

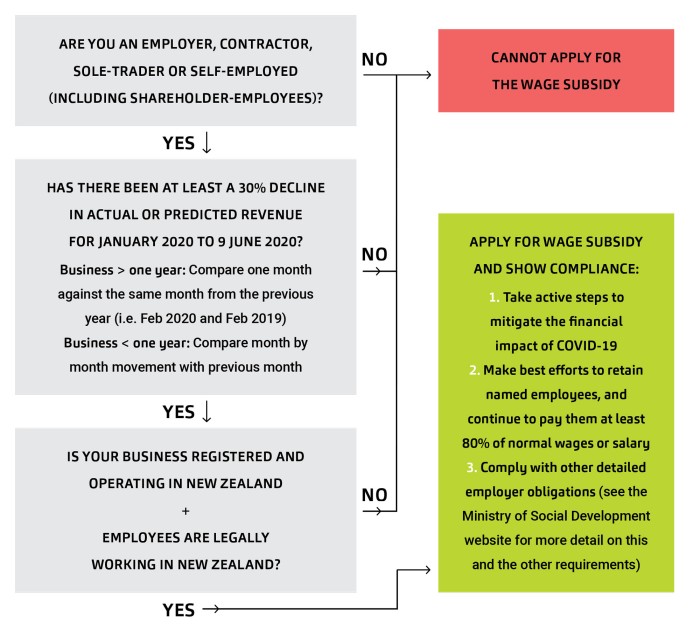

Wondering how the wage subsidy works? We have provided a process diagram and definitions.

Time to read: 3 mins

This means a business has experienced a 30% decline in:

The business must experience this decline between January 2020 and 9 June 2020.

Revenue is the total amount of money a business has earned from its normal business activities, before expenses are deducted.

Business > one year

To determine a decline in revenue, the business must compare one month’s revenue against the same month the previous year (e.g. February 2020 compared with February 2019). The revenue of the month in the affected period must be at least 30% less than it was in the month it was compared against.

Business < one year

Where a business has been operating for less than a year, they must compare their revenue against a previous month that gives the best estimation of the revenue decline related to COVID-19.

This means that a business is:

Not required to be registered with the New Zealand Companies Office, but must have:

This means a person is both:

a) working in New Zealand, and

b) is legally entitled to work in New Zealand.

A person is legally entitled to work in New Zealand if they:

The money you receive and pay onto employees as part of the wage subsidy is not taxable, and no deduction is allowed.

If you receive the wage subsidy for yourself, i.e. you are self employed or a sole trader, then the wage subsidy is taxable in the usual way.

If you are an employer paying to your employees, then withhold PAYE in the usual way.

The IRD has confirmed to us that there is no GST on the subsidy, but it may be that the law needs to be changed to effect this.

Visit the Work and Income website and complete the applicable online form.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.