Changing your business structure from sole trader to a company

Are you a sole trader or a contractor? As your business grows, you may find that you need to employ staff...

As we move out of protection mode to the recovery period one thing is clear; the world as we know it has irrevocably changed.

Time to read: 5 mins

Long term recovery from COVID-19 means building a team and business that can succeed in the face of continuous change and turbulence. As industries and regions in New Zealand move through the recovery phases, there will be knock-on effects all through different supply chains and across the country. Added to this will be the impact of external economies as countries move out of lock-down and restart manufacturing and trade.

Companies that have the best chance of surviving through this recovery period and creating a new way forward are those that can move quickly, adapt and create new ways of operating.

When thinking of the way forward and what qualities a successful business should have, their agility and resilience are the two main characteristics that come to mind. As defined by Wikipedia:

We cannot go back to the old way of doing things. The business recovery process means restarting and, in some cases, reinventing your business model. This is the time to revisit every aspect of your business.

Let’s get down to a few practical steps in achieving this.

Use your pre-COVID-19 business model as a starting point and determine the impact Covid-19 has on it. Focus on the high-risk/high-impact items and strategise around them. Be brutally honest and don’t hesitate to let go of a strategy that is no longer viable.

As the leadership team dig into the details, it is important to keep reviewing and updating your business model to evolve, as the global economy changes.

Using a Business Model Canvas to revisit your business strategy and set the course for recovery is a great way to do this.

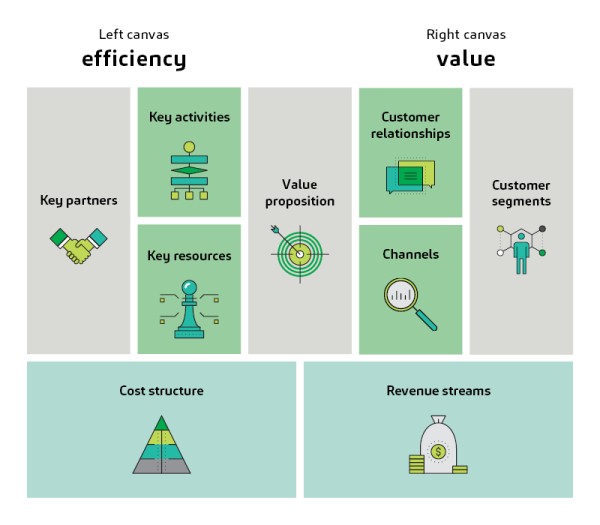

The Business Model Canvas (BMC) was developed by Alex Osterwalder and Yves Pigneur and first introduced in their book “Business Model Generation”. The business model canvas offers a visual framework for developing, planning and testing business models. I use this model with my clients when we work through the recovery process to predict - action review adapt proceed.

There are nine building blocks in the business model canvas, and they are;

The business model canvas lets you define these different components on a single page and the visual nature makes it easier to refer to an understand by everyone.

This model is flexible and can be used by any type of organisation and it helps to clarify how different aspects of the business relates to each other.

Understanding the figures that back your business model is critical in being successful in navigating through this recovery process.

Three-way modelling provides insight into the financial impact of business decisions or scenario testing to evaluate the viability of a strategy and future impacts. This allow you to be agile in your decision making and build on your resilience to “review-adapt-and-proceed” in your business recovery process.

A three-way forecast consists of the following components:

All three of these financial reports are critical and give you a full overview of your business when viewed together and not in isolation.

Your Profit and Loss shows you the anticipated profit you will make by reporting on your revenues, costs and expenses over a period.

Cashflow reports on the actual revenue coming in and cash going out. This measures the effectiveness of your debtors’ collections and repayment cycles of expenses and debt.

When you know how much cash is available you can make informed decisions on investment and spending that will impact the financial health of your business.

A balance sheet gives you a snapshot of the financial health of your business at a given point in time. While the profit and loss statement shows us how much profit was made, the balance sheet gives us detail of the unpaid bills and debt, uncollected sales invoices and net shareholders’ investment.

A balance sheet consists of the following elements:

The accounting equitation for a balance sheet:

The balance sheet is critical for banks and investors to measure the solvency, productivity and growth of the business.

By combining all three key financial reports into a consolidated forecast, you produce a granular financial forecast that sets out the financial prospects of your business model.

A three-way forecast is not just important and useful when you prepare a finance application or pitch to potential investors. It should be a critical component of your recovery plan and shaping your future.

The business owner will be the ultimate team leader, lead their team with resilience, agility and truth. With so much uncertainty around it is imperative to be open and up-front with staff on the business plan and way forward.

Your resilience will be tested when you realise a strategy is not working out and you must review-adapt-and proceed again and again, overcoming obstacles and maintain a positive forward vision. Building trust with your team during this process is critical to the success of your recovery plan and coming out on the other side.

This is your moment, seize the opportunity and shape the future of tomorrow and bring back a stronger and more resilient company than pre-COVID-19.

For further information or support to producing three-way forecasts or business models, contact your usual Baker Tilly Staples Rodway Advisor.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.