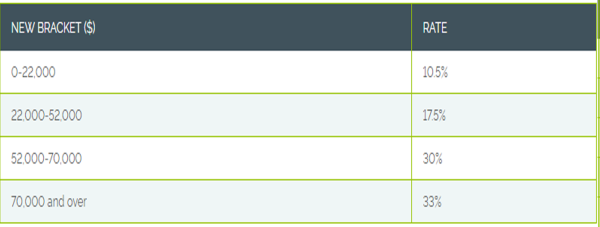

Tax relief is on the way for the average New Zealander, with the bracket creep issue identified by us in our Tax Freedom Day release earlier this month (see here) being addressed in part. The new brackets from 1 April 2018 will be:

In a Budget light on tax policy initiatives, a new Government discussion document “Black hole and feasibility expenditure” was introduced.

The Discussion Document proposes:

- Feasibility Expenditure will be either immediately deductible or depreciable.

- A deduction will now be available for expenditure that would have been deducted over time if the expenditure had been successful.

This fixes an issue arising from a recent Supreme Court decision.

The Fiscal Strategy Report continues to endorse the current tax policy focus on:

- Enhancements to Government’s broad-base, low-rate tax framework

- Using Inland Revenue’s business transformation programme to modernise and simplify tax policy and tax administration settings, and

- Dealing with issues relating to international tax and base erosion and profit shifting (BEPS).

The Government estimates $250 million of increased tax from large multinationals through to 31 March 2021. This reflects a number of measures relating to the taxation of multi-national companies operating in New Zealand.

The Independent Earner Tax Credit, which provided a tax credit of up to $10 per week to those earning between $24,000 and $48,000 per annum, and were not receiving welfare or Working for Families tax credits, is to be scrapped from 1 April 2018. The combination of this and the tax cut package above means that those previously receiving the Independent Earner Tax Credit (who don’t have children) will only be better off to the tune of 77 cents per week.

In addition to tweaking the income tax thresholds, working parents will notice an increase in their working for families tax credits from 1 April next year. Those with a first child under 16 get a further maximum of $9 per week, and for each subsequent child under 16, between $18 and $27 a week. The proposals are to ensure the parents of those children aged between 0 and 15, receive the same amount as those with children aged between 16 and 18.

However, the trade-off is the income abatement threshold now reduces from $36,350 to $35,000, and the abatement rate goes up from 22.5% to 25%.

The proposals will affect approximately 300,000 NZ families, they will give it the thumbs up.

In a surprising announcement”

The Government has allocated a staggering $15 million to be spent over the next four years on “Space Agency New Functions”.

Hopefully the Agency will have some money left after designing a new logo.

DISCLAIMER No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.